Canadian Energy Centre

Energy year in review 2023: The world doubles down on energy security and reliability

From the Canadian Energy Centre

By Shawn Logan

As global demand for oil and gas surges, pragmatism returns to the energy discussion

Faced with soaring costs that rippled across economies, governments around the world embraced the critical need for energy security in 2023, adopting a more pragmatic approach to achieving climate goals.

The world used more crude oil and coal in 2023 than anytime in human history, while global demand for liquefied natural gas (LNG) continued to grow as a vital fuel source, primarily in Europe and Asia.

Europe in particular stepped back from some of its more aggressive timelines for reducing its reliance on oil and gas, with some nations striking long-term supply deals for LNG, returning to burning coal, or renewing investment in oil and gas exploration.

Economic powerhouses China and India increasingly turned to coal to power their developing economies, spurring global growth of the most emissions-intensive fuel, while the U.S. maintained its lead as the world’s largest producer of oil and gas, setting new high water marks for both.

Canada, meanwhile, saw steady progress on some key energy projects, completing construction of the Coastal GasLink pipeline, achieving major milestones on the LNG Canda export terminal, seeing the Trans Mountain pipeline expansion near completion, and the approval of a new major oil sands project for the first time in five years.

The following is a recap of some of the key events from 2023, outlining how oil and gas have once again taken centre stage in the aftermath of Russia’s 2022 invasion of Ukraine, and the global energy crisis that it made worse:

January

- Japanese Prime Minister Fumio Kishida visits Canada to make a personal appeal for more access to LNG. Like German Chancellor Olaf Scholz just five months earlier, Kishida is essentially rebuffed by Prime Minister Justin Trudeau.

- The International Energy Agency predicts that global oil demand will reach a record high in 2023, an increase of 1.9 million barrels per day from 2022’s previous peak.

- With LNG emerging as a critical resource to deal with the lingering global energy crisis, the United States catches up to Qatar as the world’s largest exporter.

Prime Minister of Japan Fumio Kishida speaks during the G7 summit at Schloss Elmau, Germany on June 26, 2022 as (L-R) Canadian Prime Minister Justin Trudeau and German Chancellor Olaf Schulz look on. Getty Images photo

Prime Minister of Japan Fumio Kishida speaks during the G7 summit at Schloss Elmau, Germany on June 26, 2022 as (L-R) Canadian Prime Minister Justin Trudeau and German Chancellor Olaf Schulz look on. Getty Images photo

February

- India’s Prime Minister Narendra Modi projects his country will see demand for natural gas rise by 500 per cent while its share of global oil demand will increase from 5 to 11 per cent over the next 20 years. Meanwhile, India begins the search for long-term suppliers of LNG in an effort to reduce its reliance on coal.

- The bill for the 2022 energy crisis comes due in Europe, where it’s learned European governments shelled out nearly US$900 billion to shield households and businesses from its impacts. Germany, which was a world leader in transitioning to renewable energy led the way in efforts to blunt the energy crisis’ impact, handing out nearly US$300 billion in subsidies.

- Recognizing the rising global importance of reliable energy, Canadian oil producer IPC greenlights the first major new oil sands project in five years. The C$1.1 billion Blackrod project, which will be built to produce 30,000 barrels per day, is expected to be in operation by 2026. Meanwhile, Cenovus Energy filed an application to extend production at its Christina Lake oil sands project to 2079.

Remo Benzi, owner of the Hop brewery lights candles for the candlelit dinner at “Hop-Mangiare di Birra” restaurant and brewery on October 4, 2022 in Alessandria, Italy. Every Tuesday evening, since a month, the restaurant turns off the lights and lights the candles as a reaction to the high energy prices. The Italian Business Confederation estimates that nearly 120,000 companies are threatened with bankruptcy due to energy price hikes. Getty Images photo

Remo Benzi, owner of the Hop brewery lights candles for the candlelit dinner at “Hop-Mangiare di Birra” restaurant and brewery on October 4, 2022 in Alessandria, Italy. Every Tuesday evening, since a month, the restaurant turns off the lights and lights the candles as a reaction to the high energy prices. The Italian Business Confederation estimates that nearly 120,000 companies are threatened with bankruptcy due to energy price hikes. Getty Images photo

March

- China shows signs of economic resurgence after re-opening from its sweeping “zero-Covid” policies. The IEA projects China will account for nearly half of all projected growth in oil demand in 2023.

- In the U.S., the Biden Administration approves a massive new oil project in Alaska, expected to produce as much as 180,000 barrels per day of crude oil over the course of 30 years. The project is also estimated to create some $17 billion in revenue for the U.S. federal government.

- A new report by the UK-based Energy Transitions Commission finds that global investments in green energy would need to increase to $3.5 trillion per year in order to reach global net zero targets by 2050. That would add up to $110 trillion in new spending by 2050, more than the world’s current combined GDP.

A man walks towards a ferry as the Wujing coal-electricity power station is seen across the Huangpu River in the Minhang district of Shanghai. Getty Images photo

A man walks towards a ferry as the Wujing coal-electricity power station is seen across the Huangpu River in the Minhang district of Shanghai. Getty Images photo

April

- Indigenous leaders involved in Canada’s energy industry meet with diplomats from several of Canada’s G7 allies to make the case for being at the table when it comes to helping provide the energy the world needs. With Indigenous communities playing crucial roles in developing Canada’s LNG capacity, participants said diplomats showed significant interest in building economic relationships.

- Leaders of the G7 meet in Hiroshima, Japan and agree that LNG will play an “important role” in helping navigate the global energy crisis and further investment in the industry is crucial. Despite pressure to agree to a full phase out of coal by 2030, the G7 will only agree to “accelerating the phase out of domestic unabated coal.”

- A global survey that polled over 24,000 people in 28 countries found that Canada was the number one choice for countries that import oil, citing Canada’s strong record of democracy and environmental safety compared to other major producers like Saudi Arabia and Russia.

Indigenous leaders meet with U.S. ambassador to Canada David Cohen. Photo courtesy Energy for a Secure Future

Indigenous leaders meet with U.S. ambassador to Canada David Cohen. Photo courtesy Energy for a Secure Future

May

- Recognizing the growing need for energy security across Europe and the world, Norway says oil and gas companies have a “social responsibility” to find more oil and natural gas resources in the northern Barents Sea adding they should “leave no stone unturned” in the pursuit of the critical resources. A month later Norway approves $18.5 billion to develop 19 offshore oil and gas projects.

- Skyrocketing demand for oil, led primarily by China’s economic surge, forces the IEA to recalculate its predictions for the year, upgrading its demand growth estimate to 2.2 million barrels per day to further increase record usage around the world.

- Canada’s Public Policy Forum estimates phasing out the country’s oil and gas industry in an effort to reduce emissions will lead to the loss of some $100 billion to the nation’s economy by 2050, with Alberta bearing the brunt of the blow. “This essentially amounts to a deep recession without a recovery ever materializing,” the authors wrote.

Norway Minister of Petroleum and Energy Terje Assland and Equinor vice-president Grete B. Haaland at the official reopening of the Njord field on May 15th, 2023. Photo courtesy Equinor

Norway Minister of Petroleum and Energy Terje Assland and Equinor vice-president Grete B. Haaland at the official reopening of the Njord field on May 15th, 2023. Photo courtesy Equinor

June

- Qatar signs the first of several long-term LNG deals it will sign in 2023. Staring with two 27-year agreements to supply China with LNG, the Middle East supplier then signs another 15-year agreement with energy-starved Bangladesh.

- Despite Western sanctions, Russian oil companies see gasoline exports jump 37 per cent compared to 2022 thanks to new customers in Africa and Asia. Meanwhile, China’s crude oil imports from Russia soar to a record high.

- The annual Statistical Review of World Energy shows that record increases in solar and wind installations in 2022 failed to make a dent in the dominance of oil and gas in the global energy mix. Even with a record increase of 266 gigawatts of new renewable capacity, oil,gas and coal continued to represent 82 per cent of global energy consumption.

Qatar Minister of State for Energy Affairs and QatarEnergy CEO Saad Sherida Al-Kaabi tours sites related to the North Field East project in March 2023. Photo courtesy QatarGas

Qatar Minister of State for Energy Affairs and QatarEnergy CEO Saad Sherida Al-Kaabi tours sites related to the North Field East project in March 2023. Photo courtesy QatarGas

July

- The U.K. announces it will grant hundreds of new licences for oil and gas exploration in the North Sea in an effort to ensure energy security. Prime Minister Rishi Sunak says even if the U.K. achieves net zero by 2050, oil and gas will still be used for at least a quarter of its energy needs.

- Japan, one of the world’s largest energy importers, calls for the creation of a global emergency reserve for natural gas to avoid future shortages and price spikes.

- With rising global demand for LNG, the CEO of QatarEnergy predicts the tiny Middle Eastern nation will supply some 40 per cent of new LNG coming to market by 2029 as the U.S. works to significantly ramp up its industry.

A liquefied natural gas (LNG) tanker in Japan’s Tokyo Bay. Getty Images photo

A liquefied natural gas (LNG) tanker in Japan’s Tokyo Bay. Getty Images photo

August

- Independent researchers announce that China continues to ramp up coal power use, permitting 52 gigawatts of new capacity over the first six months of 2023. The additional plants would increase China’s coal burning capacity by 23 per cent.

- Independent analysis by S&P Global finds that Canada’s oil sands emissions remained flat in 2022, despite production growth, a positive sign that measures to reduce emissions are working.

- For the second year in a row, Pakistan is forced out of the pricey LNG market, putting the impoverished country at high risk of a national energy crisis.

Workers at the Sunrise oil sands project in northern Alberta. Photo courtesy BP

Workers at the Sunrise oil sands project in northern Alberta. Photo courtesy BP

September

- Meeting in India, leaders of the G20 highlight the importance of energy security, and while agreeing to triple renewable capacity by 2030 avoid any language calling for a phase out of fossil fuels. Fault lines emerge between the West and developing nations that want to harness oil, natural gas and coal to grow their economies.

- The IEA releases its updated road map for reaching net zero, suggesting global demand for fossil fuels will peak before 2030. The stance is blasted by OPEC as one that could lead to global “energy chaos” and ignores the IEA’s own acknowledgement that one the world’s current trajectory, oil, gas and coal will still account for 62 per cent of the world’s energy mix in 2050, compared to 78 per cent in 2021.

- Saudi Aramco, one of the world’s largest oil producers, announces its intention to enter the burgeoning LNG industry, buying a minority stake in MidOcean Energy, which is looking to obtain stakes in four Australian LNG projects.

A natural gas processing plant in Saudi Arabia. Photo courtesy Saudi Aramco

A natural gas processing plant in Saudi Arabia. Photo courtesy Saudi Aramco

October

- Qatar officially breaks ground on the world’s largest LNG project, which will expand its production capacity from 77 million tonnes per year to 110 million tonnes per year. The groundbreaking coincides with three new 27-year LNG supply agreements with France, Italy and the Netherlands.

- In its annual World Oil Outlook, OPEC warns the world will need $14 trillion in new investments in the oil sector by 2045 to ensure market stability and reduce the likelihood of energy shortages and economic chaos.

- The U.S. eases sanctions on Venezuela’s oil sector in exchange for the promise of free and fair elections for the South American dictatorship. Less than two weeks later, Venezuela’s supreme court suspends the results of an opposition party’s primary ahead of a 2024 national election.

View of the “Peace Monument” sculpture outside the headquarters of Venezuelan state-owned oil company PDVSA, in Caracas. Getty Images photo

View of the “Peace Monument” sculpture outside the headquarters of Venezuelan state-owned oil company PDVSA, in Caracas. Getty Images photo

November

- Three years after shovels first hit the ground, TC Energy announces it has reached mechanical completion of the Coastal GasLink pipeline. The 670-kilometre will be a critical piece of infrastructure for Canada’s developing LNG industry.

- Despite its earlier World Energy Outlook suggesting a looming peak for oil demand, the IEA revises its prediction for 2024, estimating global demand for oil will reach a new record high of 102.9 million barrels per day next year. A more bullish OPEC predicts oil demand will reach 104.4 million barrels per day in 2024.

- The U.K. government says it’s working toward legislation that would make annual oil and gas licensing rounds for the North Sea mandatory if the country is set to import more oil and gas than it produces domestically.

Coastal GasLink has surpassed 60 per cent overall project completion. Photo courtesy Coastal GasLink

Coastal GasLink has surpassed 60 per cent overall project completion. Photo courtesy Coastal GasLink

December

- World leaders leave COP28 in Dubai agreeing to eventually transition away from fossil fuels, aiming to reach carbon neutrality by 2050. But a key inclusion calls for the acceleration of low- and zero-emission technology like carbon capture and storage, an innovation in which Canada is a global leader.

- Fresh off the U.S. lifting sanctions on its oil industry, Venezuela claims sovereignty over an oil-rich region of neighbouring Guyana – accounting for about two-thirds of its territory – after ignoring ongoing proceedings in the International Court of Justice to settle the long-standing dispute.

- Russia says its crude oil exports will be seven per cent higher than in 2021 despite ongoing sanctions from the West. After losing most of its European customers, Russia reports that China and India now account for more than 90 per cent of its crude oil exports.

Russian President Vladimir Putin and executives with state oil company Rosneft present a major shipbuilding complex to Indian Prime Minister Narendra Modi. India will be an investor in a new US$157 billion oil project in the Russian Arctic. Photograph courtesy Rosneft

Russian President Vladimir Putin and executives with state oil company Rosneft present a major shipbuilding complex to Indian Prime Minister Narendra Modi. India will be an investor in a new US$157 billion oil project in the Russian Arctic. Photograph courtesy Rosneft

Alberta

REPORT: Alberta municipalities hit with $37 million carbon tax tab in 2023

Grande Prairie. Getty Images photo

From the Canadian Energy Centre

Federal cash grab driving costs for local governments, driving up property taxes

New data shows the painful economic impact of the federal carbon tax on municipalities.

Municipalities in Alberta paid out more than $37 million in federal carbon taxes in 2023, based on a recent survey commissioned by Alberta Municipal Affairs, with data provided to the Canadian Energy Centre.

About $760,000 of that came from the City of Grande Prairie. In a statement, Mayor Jackie Clayton said “if the carbon tax were removed, City property taxes could be reduced by 0.6 per cent, providing direct financial relief to residents and businesses in Grande Prairie.”

Conducted in October, the survey asked municipal districts, towns and cities in Alberta to disclose the amount of carbon tax paid out for the heating and electrifying of municipal assets and fuel for fleet vehicles.

With these funds, Alberta municipalities could have hired 7,789 high school students at $15 per hour last year with the amount paid to Ottawa.

The cost on municipalities includes:

Lloydminster: $422,248

Calgary: $1,230,300 (estimate)

Medicine Hat: $876,237

Lethbridge: $1,398,000 (estimate)

Grande Prairie: $757,562

Crowsnest Pass: $71,100

Red Deer: $1,495,945

Bonnyville: $19,484

Hinton: $66,829

Several municipalities also noted substantial indirect costs from the carbon tax, including higher rates from vendors that serve the municipality – like gravel truck drivers and road repair providers – passing increased fuel prices onto local governments.

The rising price for materials and goods like traffic lights, steel, lumber and cement, due to higher transportation costs are also hitting the bottom line for local governments.

The City of Grande Prairie paid out $89 million in goods and services in 2023, and the indirect costs of the carbon tax “have had an inflationary impact on those expenses” in addition to the direct costs of the tax.

In her press conference announcing Alberta’s challenge to the federal carbon tax on Oct. 29, 2024, Premier Danielle Smith addressed the pressures the carbon tax places on municipal bottom lines.

“In 2023 alone, the City of Calgary could have hired an additional 112 police officers or firefighters for the amount they sent to Ottawa for the carbon tax,” she said.

In a statement issued on Oct. 7, 2024, Ontario Conservative MP Ryan Williams, shadow minister for international trade, said this issue is nationwide.

“In Belleville, Ontario, the impact of the carbon tax is particularly notable. The city faces an extra $410,000 annually in costs – a burden that directly translates to an increase of 0.37 per cent on residents’ property tax bills.”

There is no rebate yet provided on retail carbon pricing for towns, cities and counties.

In October, the council in Belleville passed a motion asking the federal government to return in full all carbon taxes paid by municipalities in Canada.

The unaltered reproduction of this content is free of charge with attribution to the Canadian Energy Centre.

Canadian Energy Centre

Ignoring the global picture and making Canadians poorer: Energy and economic leaders on Ottawa’s oil and gas emissions cap

From the Canadian Energy Centre

The federal government’s draft rules to cap emissions – and by credible analysis, production – from Canada’s oil and gas sector will make Canadians poorer, won’t reduce world emissions, and are a “slap in the face” to Indigenous communities.

That’s the view of several leaders in energy and the economy calling out the negative consequences of Ottawa’s new regulations, which were announced on November 4.

Here’s a selection of what they have to say.

Goldy Hyder, CEO, Business Council of Canada

“At a time when Canada’s economy is stalling, imposing an oil and gas emissions cap will only make Canadians poorer. Strong climate action requires a strong economy. This cap will leave us with neither.”

Deborah Yedlin, CEO, Calgary Chamber of Commerce

“Canada would stand as the only country in the world to move forward with a self-imposed emissions cap.

“Given that our economic growth numbers have been underwhelming–and our per-person productivity lags that of the United States by $20,000, one would expect the government to be more focused on supporting sectors that are critical to economic growth rather than passing legislation that will compromise investment and hamper our growth prospects.

“…If the Canadian government wants to reduce emissions, it should follow the private sector’s lead – and strong track record – and withdraw the emissions cap.”

Stephen Buffalo, CEO, Indian Resources Council of Canada

“Over the past four decades, Canadian governments urged and promoted Indigenous peoples to engage in the natural resource economy. We were anxious to break our dependence on government and, even more, to exercise our treaty and Indigenous rights to build our own economies. We jumped in with far more enthusiasm and commitment than most Canadians appreciate.

“And now, in a bid to make Canada look ecologically virtuous on the world stage, the Liberal government imposed further restrictions on the oil and gas sector. This is happening as Indigenous engagement, employment and equity investment are growing and at a time when our communities have had their first taste of real and sustainable prosperity since the newcomers killed off all the buffalo. Thanks for nothing.”

Trevor Tombe, professor of economics, University of Calgary School of Public Policy

“[The emissions cap] is a wedge issue that’s going to be especially popular in Quebec. And I don’t think the [federal government’s] thinking goes much further than that.”

Kendall Dilling, president, Pathways Alliance

“A decrease in Canadian production has no impact on global demand – meaning another country’s oil will simply fill the void and the intended impact of the emissions cap is negated at a global level.

“An emissions cap gives industry less – not more – of the certainty needed to make long-term investments that create jobs, economic growth and tax revenues for all levels of government. It simply makes Canada less competitive.”

Michael Belenkie, CEO, Advantage Energy

“Canada’s emissions profile is not unusual. What’s unusual about Canada and our emissions is we seem to be the only exporting nation of the world that is willing to self-immolate. All we’re doing is we’re shutting ourselves down at our own expense and watching global emissions increase.”

Kevin Krausert, CEO and co-founder, Avatar Innovations

“The emissions cap risks delaying – if not derailing – a whole suite of emissions-reduction technology projects. The reason is simple: it has added yet another layer of uncertainty and complexity on already skinny investment decisions by weakening the most effective mechanism Canada has in place.

“…After nearly 15 years of experimenting in a complicated regulatory system, we’ve finally landed on one of the most globally effective and fungible carbon markets in the world in Alberta, called TIER.

“What the federal emissions cap has done is introduce uncertainty about the future of TIER. That’s because the cap has its own newly created cap-and-trade system. It takes TIER’s 15 years of experience and market knowledge and either duplicates functioning markets or creates a whole new market that may take another 15 years to get right.”

Dennis Darby, CEO, Canadian Manufacturers & Exporters

“The federal government’s announcement of a cap and trade on oil and gas emissions threatens Canada’s energy trade, economic interests, and national unity.”

Adam Legge, president, Business Council of Alberta

“The oil and gas emissions cap is a discriminatory and divisive policy proposal—the epitome of bad public policy. It will likely cap Canadian prosperity—billions of dollars and tens of thousands of jobs lost for no benefit, and the burden will be borne largely in one region and one sector.”

Lisa Baiton, CEO, Canadian Association of Petroleum Producers

“The result would be lower production, lower exports, fewer jobs, lower GDP and lower revenues to governments to fund critical infrastructure and social programs on which Canadians rely.”

Statement, Canadian Association of Energy Contractors

“The Trudeau government does not care about Canadian blue-collar, middle-class energy workers who rely on the industry to support their families. It does not care about small, medium and Indigenous energy service businesses that operate in rural and remote communities across Western Canada. And it certainly does not care about supporting our allies who are desperate for oil and gas from sources other than regimes such as Russia or Iran.”

Peter Tertzakian, executive director, ARC Energy Research Institute

“Focusing on a single sector while ignoring others is problematic because each tonne of emissions has the same impact on climate change, regardless of its source. It makes little sense to impose potentially higher economic burdens on one economic sector when you could reduce emissions elsewhere at a lower cost.”

Shannon Joseph, chair, Energy for a Secure Future

“Canada continues to pursue its climate policy in a vacuum, ignoring the big picture of global emissions. This places at risk our international interests, tens of thousands of good paying jobs and important progress on reconciliation.”

Adam Sweet, director for Western Canada, Clean Prosperity

“Layering on a new cap-and-trade system for oil and gas producers adds uncertainty and regulatory complexity that risks undermining investment in emissions reductions just as we’re getting close to landing significant new decarbonization projects here in Alberta.”

-

Brownstone Institute1 day ago

Brownstone Institute1 day agoThe Most Devastating Report So Far

-

Economy2 days ago

Economy2 days agoCOP 29 leaders demand over a $1 trillion a year in climate reparations from ‘wealthy’ nations. They don’t deserve a nickel.

-

Censorship Industrial Complex1 day ago

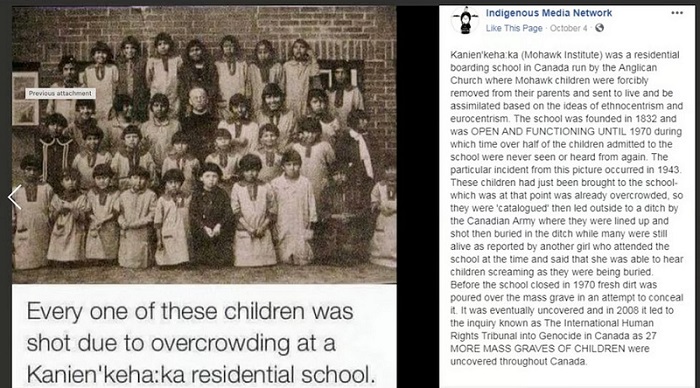

Censorship Industrial Complex1 day agoAnother Mass Grave?

-

ESG11 hours ago

ESG11 hours agoCan’t afford Rent? Groceries for your kids? Trudeau says suck it up and pay the tax!

-

Alberta1 day ago

Alberta1 day agoMAiD In Alberta: Province surveying Albertans about assisted suicide policies

-

Energy1 day ago

Energy1 day agoOttawa’s proposed emission cap lacks any solid scientific or economic rationale

-

Alberta1 day ago

Alberta1 day agoOn gender, Alberta is following the science

-

International12 hours ago

International12 hours agoElon Musk praises families on X: ‘We should teach fear of childlessness,’ not pregnancy