Energy

Why Canada should get carbon credits for LNG exports

From the MacDonald Laurier Institute

By Jerome Gessaroli

Generating carbon credits from LNG exports is potentially a cost-effective way to reduce GHGs globally while helping to meet our carbon reduction goals

It stands to reason that Canada should get carbon credits for replacing dirty coal-fired energy sources in Asia with our cleaner natural gas, preventing the release of many megatonnes of greenhouse gas emissions. But as the issue currently stands, we won’t.

However, there’s hope for reason.

A recent paper I wrote for the Macdonald-Laurier Institute sheds light on the confusion surrounding this matter. Based on the 2015 Paris Agreement, specifically Article 6, and the subsequently developed guidelines for the sharing of carbon reduction credits, liquid natural gas exports should be eligible to generate such credits for Canada — just not in a way envisioned by provincial leaders.

Former B.C. premier Christy Clark and successive premiers have argued since 2013 that LNG exports alone should be counted toward carbon credits for Canada and its provinces. Researchers estimate that if Asian countries replace coal with natural gas in their power plants, emissions would fall by 34 to 62 per cent.

However, each time this argument resurfaces, it faces criticism from various quarters.

The confusion over sharing carbon credits arises from the disconnect between the idea’s simplicity and its complex implementation.

Carbon credit eligibility is based on the principle that only emission reduction projects that would not have proceeded without access to carbon credits meet a so-called “additionality” criterion. While there are other criteria, the additionality criterion is the heart of credits sharing regime.

A straightforward LNG export contract with an Asian utility that substitutes gas for coal would probably not be eligible to generate any carbon credits for the Canadian side. While the deal does lower GHG emissions, those reductions are not “additional” and the deal would go ahead with or without the availability of emissions credits.

However, there is another scenario that would likely qualify to receive carbon credits. In this scenario, in addition to selling LNG, the Canadian company helps the Asian utility convert its coal-fuelled plant to a natural gas plant. In this case, the utility’s motivation is to avoid prematurely shuttering its power plant and losing its investment due to stricter emission standards.

On the Canadian side, support may involve providing technical services, financing or other assistance. While more costly for Canada, those extra expenses could be more than offset by the value of carbon credits transferred by the Asian side. Canada would win by accruing revenue from the sale of LNG, providing additional Canadian-based services, and receiving valuable carbon credits to help meet our emissions targets. This deal is “additional” – its feasibility is contingent on its eligibility for carbon credits.

Critics warn that selling LNG abroad will “lock in” fossil fuel use and delay the transition to renewables. The reality is that the average age of Asian coal-fuelled power plants is only 13 years (with a lifespan of up to 40 years) and that over 1,000 new coal plants have been announced, permitted or are currently under construction.

These are the facts, whether we like them or not. This reminds me of the quote often attributed to John Maynard Keynes, “As the facts change, I change my mind. What do you do, sir?” What we can do is assist in switching some of these plants from burning coal to LNG, which will substantially reduce GHG emissions over the short and medium term; not to mention help energy workers keep their jobs.

Critics also assert that producing LNG in British Columbia creates emissions which could prevent the province from meeting its own emission reduction targets. Yet studies estimate that using just over half of LNG Canada’s annual Phase 1 production capacity to replace coal could reduce international GHG emissions by 14 to 34 Mt while increasing yearly emissions in B.C. by less than two megatonnes.

Creating the infrastructure to transfer carbon credits under the Paris Agreement is a complex and relatively new endeavour. Earning carbon credits is also a non-trivial task. It will require the federal government to initiate bilateral agreements and negotiate common policies and practices with any partnering country for calculating, verifying, allocating and transferring credits. Alberta and B.C. are already co-operating.

Generating carbon credits from LNG exports is potentially a cost-effective way to reduce GHGs globally while helping to meet our carbon reduction goals.

Jerome Gessaroli is a senior fellow at the Macdonald-Laurier Institute and leads The Sound Economic Policy Project at the British Columbia Institute of Technology

Alberta

REPORT: Alberta municipalities hit with $37 million carbon tax tab in 2023

Grande Prairie. Getty Images photo

From the Canadian Energy Centre

Federal cash grab driving costs for local governments, driving up property taxes

New data shows the painful economic impact of the federal carbon tax on municipalities.

Municipalities in Alberta paid out more than $37 million in federal carbon taxes in 2023, based on a recent survey commissioned by Alberta Municipal Affairs, with data provided to the Canadian Energy Centre.

About $760,000 of that came from the City of Grande Prairie. In a statement, Mayor Jackie Clayton said “if the carbon tax were removed, City property taxes could be reduced by 0.6 per cent, providing direct financial relief to residents and businesses in Grande Prairie.”

Conducted in October, the survey asked municipal districts, towns and cities in Alberta to disclose the amount of carbon tax paid out for the heating and electrifying of municipal assets and fuel for fleet vehicles.

With these funds, Alberta municipalities could have hired 7,789 high school students at $15 per hour last year with the amount paid to Ottawa.

The cost on municipalities includes:

Lloydminster: $422,248

Calgary: $1,230,300 (estimate)

Medicine Hat: $876,237

Lethbridge: $1,398,000 (estimate)

Grande Prairie: $757,562

Crowsnest Pass: $71,100

Red Deer: $1,495,945

Bonnyville: $19,484

Hinton: $66,829

Several municipalities also noted substantial indirect costs from the carbon tax, including higher rates from vendors that serve the municipality – like gravel truck drivers and road repair providers – passing increased fuel prices onto local governments.

The rising price for materials and goods like traffic lights, steel, lumber and cement, due to higher transportation costs are also hitting the bottom line for local governments.

The City of Grande Prairie paid out $89 million in goods and services in 2023, and the indirect costs of the carbon tax “have had an inflationary impact on those expenses” in addition to the direct costs of the tax.

In her press conference announcing Alberta’s challenge to the federal carbon tax on Oct. 29, 2024, Premier Danielle Smith addressed the pressures the carbon tax places on municipal bottom lines.

“In 2023 alone, the City of Calgary could have hired an additional 112 police officers or firefighters for the amount they sent to Ottawa for the carbon tax,” she said.

In a statement issued on Oct. 7, 2024, Ontario Conservative MP Ryan Williams, shadow minister for international trade, said this issue is nationwide.

“In Belleville, Ontario, the impact of the carbon tax is particularly notable. The city faces an extra $410,000 annually in costs – a burden that directly translates to an increase of 0.37 per cent on residents’ property tax bills.”

There is no rebate yet provided on retail carbon pricing for towns, cities and counties.

In October, the council in Belleville passed a motion asking the federal government to return in full all carbon taxes paid by municipalities in Canada.

The unaltered reproduction of this content is free of charge with attribution to the Canadian Energy Centre.

Energy

Global fossil fuel use rising despite UN proclamations

From the Fraser Institute

By Julio Mejía and Elmira Aliakbari

Major energy transitions are slow and take centuries, not decades… the first global energy transition—from traditional biomass fuels (including wood and charcoal) to fossil fuels—started more than two centuries ago and remains incomplete. Nearly three billion people in the developing world still depend on charcoal, straw and dried dung for cooking and heating, accounting for about 7 per cent of the world’s energy supply (as of 2020).

At the Conference of the Parties (COP29) in Azerbaijan, António Guterres, the United Nations Secretary-General, last week called for a global net-zero carbon footprint by 2050, which requires a “fossil fuel phase-out” and “deep decarbonization across the entire value chain.”

Yet despite the trillions of dollars already spent globally pursuing this target—and the additional trillions projected as necessary to “end the era of fossil fuels”—the world’s dependence on fossil fuels has remained largely unchanged.

So, how realistic is a “net-zero” emissions world—which means either eliminating fossil fuel generation or offsetting carbon emissions with activities such as planting trees—by 2050?

The journey began in 1995 when the UN hosted the first COP conference in Berlin, launching a global effort to drive energy transition and decarbonization. That year, global investment in renewable energy reached US$7 billion, according to some estimates. Since then, an extraordinary amount of money and resources have been allocated to the transition away from fossil fuels.

According to the International Energy Agency, between 2015 and 2023 alone, governments and industry worldwide spent US$12.3 trillion (inflation-adjusted) on clean energy. For context, that’s over six times the value of the entire Canadian economy in 2023.

Despite this spending, between 1995 and 2023, global fossil fuel consumption increased by 62 per cent, with oil consumption rising by 38 per cent, coal by 66 per cent and natural gas by 90 per cent.

And during that same 28-year period, despite the trillions spent on energy alternatives, the share of global energy provided by fossil fuels declined by only four percentage points, from 85.6 per cent to 81.5 per cent.

This should come as no surprise. Major energy transitions are slow and take centuries, not decades. According to a recent study by renowned scholar Vaclav Smil, the first global energy transition—from traditional biomass fuels (including wood and charcoal) to fossil fuels—started more than two centuries ago and remains incomplete. Nearly three billion people in the developing world still depend on charcoal, straw and dried dung for cooking and heating, accounting for about 7 per cent of the world’s energy supply (as of 2020).

Moreover, coal only surpassed wood as the main energy source worldwide around 1900. It took more than 150 years from oil’s first commercial extraction for oil to reach 25 per cent of all fossil fuels consumed worldwide. Natural gas didn’t reach this threshold until the end of the 20th century, after 130 years of industry development.

Now, consider the current push by governments to force an energy transition via regulation and spending. In Canada, the Trudeau government has set a target to fully decarbonize electricity generation by 2035 so all electricity is derived from renewable power sources such as wind and solar. But merely replacing Canada’s existing fossil fuel-based electricity with clean energy sources within the next decade would require building the equivalent of 23 major hydro projects (like British Columbia’s Site C) or 2.3 large-scale nuclear power plants (like Ontario’s Bruce Power). The planning and construction of significant electricity generation infrastructure in Canada is a complex and time-consuming process, often plagued by delays, regulatory hurdles and substantial cost overruns.

The Site C project took around 43 years from initial feasibility studies in 1971 to securing environmental certification in 2014. Construction began on the Peace River in northern B.C. in 2015, with completion expected in 2025 at a cost of at least $16 billion. Similarly, Ontario’s Bruce Power plant took nearly two decades to complete, with billions in cost overruns. Given these immense practical, financial and regulatory challenges, achieving the government’s 2035 target is highly improbable.

As politicians gather at high-profile conferences and set ambitious targets for a swift energy transition, global reliance on fossil fuels has continued to increase. As things stand, achieving net-zero by 2050 appears neither realistic nor feasible.

Authors:

-

Brownstone Institute21 hours ago

Brownstone Institute21 hours agoThe Most Devastating Report So Far

-

Economy1 day ago

Economy1 day agoCOP 29 leaders demand over a $1 trillion a year in climate reparations from ‘wealthy’ nations. They don’t deserve a nickel.

-

Censorship Industrial Complex1 day ago

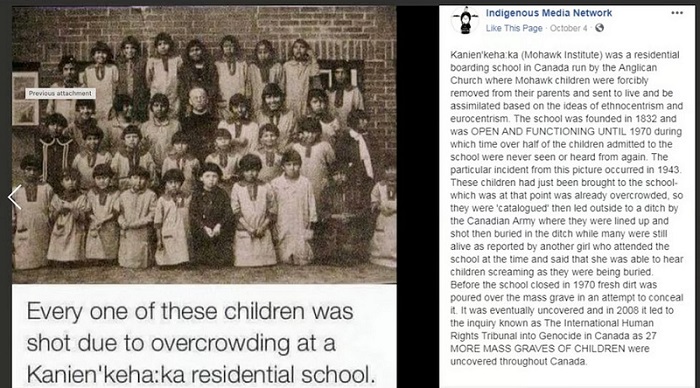

Censorship Industrial Complex1 day agoAnother Mass Grave?

-

ESG8 hours ago

ESG8 hours agoCan’t afford Rent? Groceries for your kids? Trudeau says suck it up and pay the tax!

-

Alberta1 day ago

Alberta1 day agoMAiD In Alberta: Province surveying Albertans about assisted suicide policies

-

Energy1 day ago

Energy1 day agoOttawa’s proposed emission cap lacks any solid scientific or economic rationale

-

Alberta1 day ago

Alberta1 day agoOn gender, Alberta is following the science

-

International9 hours ago

International9 hours agoElon Musk praises families on X: ‘We should teach fear of childlessness,’ not pregnancy