Automotive

Can Metal Mining Match the Speed of the Planned Electric Vehicle Transition?

From the Fraser Institute

The governments of Canada, the United States, and many other nations are mandating a shift in vehicle technology: away from vehicles powered primarily by internal combustion engines, and toward vehicles powered primarily with electricity stored on board in batteries.

Canada’s government has established policies designed to push automakers to achieve the government’s goal of having 35 percent of all new medium- and heavy-duty vehicle sales be electric by 2030, rising to 100 percent of all new medium- and heavy-duty vehicle sales being electric by 2040.

The US has set a target requiring 50 percent of all new passenger cars and light trucks sold in 2030 be electric, or largely electric hybrid vehicles. These timelines are ambitious, calling for a major expansion of the prevalence of electric vehicles (EVs) in the major vehicle classes in a very short time—only 7 to 10 years.

Barring breakthrough developments in battery technology, this massive and rapid expansion of battery-electric vehicle production will require a correspondingly massive and rapid expansion of the mining and refining of the metals and rare earth elements critical to battery-electric vehicle technology.

The International Energy Agency (IEA) suggests that to meet international EV adoption pledges, the world will need 50 new lithium mines by 2030, along with 60 new nickel mines, and 17 new cobalt mines. The materials needed for cathode production will require 50 more new mines, and anode materials another 40. The battery cells will require 90 new mines, and EVs themselves another 81. In total, this adds up to 388 new mines. For context, as of 2021, there were only 270 metal mines operating across the US, and only 70 in Canada. If Canada and the US wish to have internal supply chains for these vital EV metals, they have a lot of mines to establish in a very short period.

Historically, however, mining and refining facilities are both slow to develop and are highly uncertain endeavors plagued by regulatory uncertainty and by environmental and regulatory barriers. Lithium production timelines, for example, are approximately 6 to 9 years, while production timelines (from application to production) for nickel are approximately 13 to 18 years, according to the IEA.

The establishment of aggressive and short-term EV adoption goals sets up a potential conflict with metal and mineral production, which is historically characterized by long lead-times and long production timelines. The risk that mineral and mining production will fall short of projected demand is significant, and could greatly affect the success of various governments’ plans for EV transition.

Author:

Automotive

Electric cars just another poor climate policy

From the Fraser Institute

The electric car is widely seen as a symbol of a simple, clean solution to climate change. In reality, it’s inefficient, reliant on massive subsidies, and leaves behind a trail of pollution and death that is seldom acknowledged.

We are constantly reminded by climate activists and politicians that electric cars are cleaner, cheaper, and better. Canada and many other countries have promised to prohibit the sale of new gas and diesel cars within a decade. But if electric cars are really so good, why would we need to ban the alternatives?

And why has Canada needed to subsidize each electric car with a minimum $5,000 from the federal government and more from provincial governments to get them bought? Many people are not sold on the idea of an electric car because they worry about having to plan out where and when to recharge. They don’t want to wait for an uncomfortable amount of time while recharging; they don’t want to pay significantly more for the electric car and then see its used-car value decline much faster. For people not privileged to own their own house, recharging is a real challenge. Surveys show that only 15 per cent of Canadians and 11 per cent of Americans want to buy an electric car.

The main environmental selling point of an electric car is that it doesn’t pollute. It is true that its engine doesn’t produce any CO₂ while driving, but it still emits carbon in other ways. Manufacturing the car generates emissions—especially producing the battery which requires a large amount of energy, mostly achieved with coal in China. So even when an electric car is being recharged with clean power in BC, over its lifetime it will emit about one-third of an equivalent gasoline car. When recharged in Alberta, it will emit almost three-quarters.

In some parts of the world, like India, so much of the power comes from coal that electric cars end up emitting more CO₂ than gasoline cars. Across the world, on average, the International Energy Agency estimates that an electric car using the global average mix of power sources over its lifetime will emit nearly half as much CO₂ as a gasoline-driven car, saving about 22 tonnes of CO₂.

But using an electric car to cut emissions is incredibly ineffective. On America’s longest-established carbon trading system, you could buy 22 tonnes of carbon emission cuts for about $660 (US$460). Yet, Ottawa is subsidizing every electric car to the tune of $5,000 or nearly ten times as much, which increases even more if provincial subsidies are included. And since about half of those electrical vehicles would have been bought anyway, it is likely that Canada has spent nearly twenty-times too much cutting CO₂ with electric cars than it could have. To put it differently, Canada could have cut twenty-times more CO₂ for the same amount of money.

Moreover, all these estimates assume that electric cars are driven as far as gasoline cars. They are not. In the US, nine-in-ten households with an electric car actually have one, two or more non-electric cars, with most including an SUV, truck or minivan. Moreover, the electric car is usually driven less than half as much as the other vehicles, which means the CO₂ emission reduction is much smaller. Subsidized electric cars are typically a ‘second’ car for rich people to show off their environmental credentials.

Electric cars are also 320–440 kilograms heavier than equivalent gasoline cars because of their enormous batteries. This means they will wear down roads faster, and cost societies more. They will also cause more air pollution by shredding more particulates from tire and road wear along with their brakes. Now, gasoline cars also pollute through combustion, but electric cars in total pollute more, both from tire and road wear and from forcing more power stations online, often the most polluting ones. The latest meta-study shows that overall electric cars are worse on particulate air pollution. Another study found that in two-thirds of US states, electric cars cause more of the most dangerous particulate air pollution than gasoline-powered cars.

These heavy electric cars are also more dangerous when involved in accidents, because heavy cars more often kill the other party. A study in Nature shows that in total, heavier electric cars will cause so many more deaths that the toll could outweigh the total climate benefits from reduced CO₂ emissions.

Many pundits suggest electric car sales will dominate gasoline cars within a few decades, but the reality is starkly different. A 2023-estimate from the Biden Administration shows that even in 2050, more than two-thirds of all cars globally will still be powered by gas or diesel.

Source: US Energy Information Administration, reference scenario, October 2023

Fossil fuel cars, vast majority is gasoline, also some diesel, all light duty vehicles, the remaining % is mostly LPG.

Electric vehicles will only take over when innovation has made them better and cheaper for real. For now, electric cars run not mostly on electricity but on bad policy and subsidies, costing hundreds of billions of dollars, blocking consumers from choosing the cars they want, and achieving virtually nothing for climate change.

Automotive

Trump warns U.S. automakers: Do not raise prices in response to tariffs

MxM News

MxM News

Quick Hit:

Former President Donald Trump warned automakers not to raise car prices in response to newly imposed tariffs, arguing that the move would ultimately benefit the industry by strengthening American manufacturing. However, automakers are signaling that price increases may be unavoidable.

Key Details:

- Trump told auto executives on a recent call that his administration would look unfavorably on price hikes due to tariffs.

- A 25% tariff on imported vehicles and parts is set to take effect on April 2, likely driving up costs for U.S. automakers.

- Industry analysts predict vehicle prices could rise 11% to 12% in response, despite Trump’s insistence that tariffs will benefit American manufacturing.

Diving Deeper:

In a conference call with leading automakers earlier this month, former President Donald Trump issued a stern warning: do not use his new tariffs as an excuse to raise car prices. While Trump presented the tariffs as a boon for American manufacturing, industry leaders remain unconvinced, arguing that the financial burden will inevitably lead to higher costs for consumers.

Trump’s administration is pressing ahead with a 25% tariff on all imported vehicles and parts, set to take effect on April 2. The move is aimed at reshaping trade dynamics in the auto industry, encouraging domestic manufacturing, and reversing what Trump calls the damaging effects of President Joe Biden’s electric vehicle mandates. Despite this, automakers say that rising costs on foreign parts—which many depend on—will leave them little choice but to pass expenses onto consumers.

“You’re going to see prices going down, but going to go down specifically because they’re going to buy what we’re doing, incentivizing companies to—and even countries—companies to come into America,” Trump stated at a recent event, reinforcing his stance that the tariffs will ultimately lower costs in the long run.

However, industry insiders are pushing back, warning that a rapid shift to domestic production is unrealistic. “Tariffs, at any level, cannot be offset or absorbed,” said Ray Scott, CEO of Lear, a major automotive parts supplier. His concern reflects broader anxieties within the industry, as automakers calculate the financial strain of the tariffs. Analysts at Morgan Stanley estimate that vehicle prices could increase between 11% and 12% in the coming months as the new tariffs take effect.

Automakers have been bracing for the fallout. Detroit’s major manufacturers and industry suppliers have voiced their concerns, emphasizing that transitioning supply chains and manufacturing operations back to the U.S. will take years. Meanwhile, auto retailers have stocked up on inventory, temporarily shielding consumers from price hikes. But once that supply runs low—likely by May—the full impact of the tariffs could hit.

Within the Trump administration, inflation remains a pressing concern, though Trump himself rarely discusses it publicly. His economic team is aware of the potential for tariffs to drive up costs, yet the administration’s stance remains firm: automakers must adapt without raising prices. It remains unclear, however, what actions Trump might take should automakers defy his warning.

The auto industry isn’t alone in its concerns. Executives across multiple sectors, from oil and gas to food manufacturing, have been lobbying against major tariffs, arguing that they will inevitably result in higher prices for American consumers. While Trump has largely dismissed these warnings, some analysts suggest that public dissatisfaction with rising costs played a key role in shaping the outcome of the 2024 election.

With the tariffs set to take effect in just weeks, automakers are left grappling with a difficult reality: absorb billions in new costs or risk the ire of a White House determined to remake America’s trade policies.

-

2025 Federal Election2 days ago

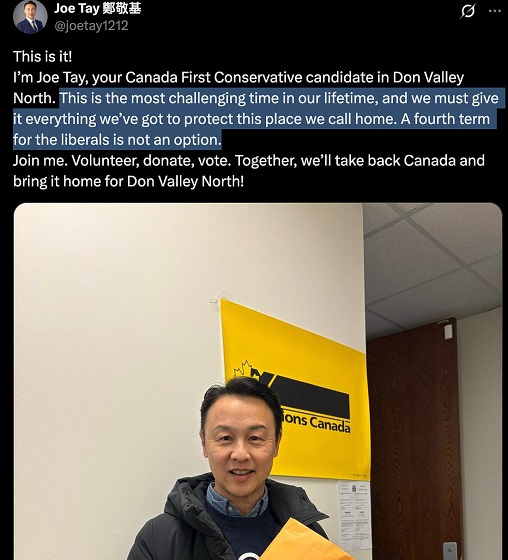

2025 Federal Election2 days agoJoe Tay Says He Contacted RCMP for Protection, Demands Carney Fire MP Over “Bounty” Remark

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoHong Kong-Canadian Groups Demand PM Carney Drop Liberal Candidate Over “Bounty” Remark Supporting CCP Repression

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPoilievre To Create ‘Canada First’ National Energy Corridor

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoAlcohol tax and MP pay hike tomorrow (April 1)

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoChina Election Interference – Parties Received Security Briefing Days Ago as SITE Monitors Threats to Conservative Candidate Joe Tay

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoFixing Canada’s immigration system should be next government’s top priority

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPoilievre, Conservatives receive election endorsement from large Canadian trade union

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoAre the Jays Signing Or Declining? Only Vladdy & Bo Know For Sure