Alberta

No Matter Which Formula, Albertans Win With An Alberta Pension Plan

From the Alberta Institute

Guest Post By Lindsay Wilson

Opponents of the Alberta Pension Plan (APP) have wasted no time busting out the pitchforks, with their legacy media lapdogs hard at work toeing the line for the union big wigs and their NDP friends.

It’s merely weeks into the launch of a province-wide public consultation to educate and get feedback from Albertans on an APP and there is no shortage of Trudeau-funded media penning pieces laden with misinformation.

They’re pushing a fear-based narrative that has seniors running scared and reasonable people questioning whether the bold move isn’t a little selfish which is no different than what Quebec has been doing — quite successfully — since day one.

For us here at Alberta Proud, we not only think opting out of the Canada Pension Plan (CPP) and establishing an APP is a great idea — it’s a critical step toward more Alberta autonomy.

If we don’t, will we ever achieve much of anything in the arena of autonomy? Think about it: if we can’t win a referendum on the one thing we don’t need permission from Ottawa to do, where does that leave us?

More Alberta and Less Ottawa isn’t just a pie in the sky for us at Alberta Proud. It’s our mantra.

We genuinely believe enough is enough. It’s time for Ottawa to take a hike, including their antiquated equalization formula that you voted 62% in favour of scrapping.

We now have an opportunity to leave the CPP, in favour of a made-in-Alberta plan which must offer the same or better benefits. And it will, without question, put more money into your pocket every year as we finally won’t be overcontributing.

The newest twist in the anti-APP narrative is casting doubt on the formula the independent, government-commissioned LifeWorks report produced: that 53% of the CPP assets ($334 billion) would be owed to Alberta.

By switching to an APP, that translates to putting an additional $1,425 back into each employee’s pocket, according to LifeWorks, and when you consider the employer’s contribution, that amount is effectively doubled.

That’s a huge incentive for Alberta employers, those coming here to work and for the majority of hard-working everyday people who are drowning in this era of inflation (or #justinflation as we like to call it at Alberta Proud).

Meanwhile in the mainstream media, economist Trevor Tombe is balking at the math, claiming Albertans will be owed around one-third of what LifeWorks has assessed.

While it may seem odd everyone is arriving at different numbers, here is the kicker: even if we leave with only 17% (among the lower estimates floating around and not the 25% estimated by Tombe or the 53% estimated by LifeWorks) it’s still a better deal for Albertans.

But how, you ask? Simply put, we would finally get a break from this hidden transfer program, which is yet another way in which hardworking Albertans subsidize the rest of the country.

We have a comparatively younger population and because of this, we have paid more than we have collected. It has always been this way for us, and it doesn’t look like that will change. In the past year, a record 185,000 new Albertans moved here to work and take advantage of our low taxes and abundant opportunities. Any way you slice it, our contribution rate would fall.

Another concern is around who will manage an APP.

While the opposition is quick to point out CPP investment returns have been decent and that an APP would be best not left in the hands of AIMCo, did you know we could very well use the same pension fund manager as the CPP or another arms-length, third party?

By putting Alberta first, you will not risk your pension.

By switching to an APP, you will put more money in your pocket.

Ottawa has long turned its back on Albertans and continues to hit us with eco-radical regulations that will leave us broke and freezing in the dark. If we stay in the CPP, we are sending them a message that they can keep pushing us around, forever, no matter what they do to us.

It’s time for a change.

So, take a moment to fill out the Alberta government survey.

Send emails to your MLA, Finance Minister Nate Horner and Premier Danielle Smith. Show up to the townhalls.

Alberta’s future of more autonomy depends on all of us getting loud and Alberta Proud!

Lindsay Wilson is the President of Alberta Proud, a group of citizens concerned about Alberta’s future within Canada.

Alberta

Premier Smith says Auto Insurance reforms mean lower premiums and better services for Alberta drivers

Premier Smith says Auto Insurance reforms may still result in a publicly owned system

Better, faster, more affordable auto insurance

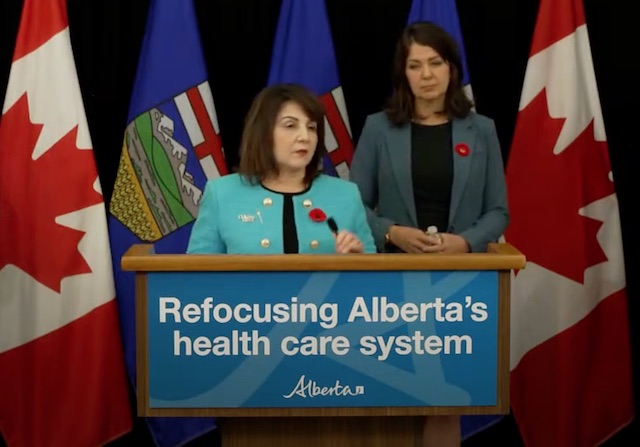

Alberta’s government is introducing a new auto insurance system that will provide better and faster services to Albertans while reducing auto insurance premiums.

After hearing from more than 16,000 Albertans through an online survey about their priorities for auto insurance policies, Alberta’s government is introducing a new privately delivered, care-focused auto insurance system.

Right now, insurance in the province is not affordable or care focused. Despite high premiums, Albertans injured in collisions do not get the timely medical care and income support they need in a system that is complex to navigate. When fully implemented, Alberta’s new auto insurance system will deliver better and faster care for those involved in collisions, and Albertans will see cost savings up to $400 per year.

“Albertans have been clear they need an auto insurance system that provides better, faster care and is more affordable. When it’s implemented, our new privately delivered, care-centred insurance system will put the focus on Albertans’ recovery, providing more effective support and will deliver lower rates.”

“High auto insurance rates put strain on Albertans. By shifting to a system that offers improved benefits and support, we are providing better and faster care to Albertans, with lower costs.”

Albertans who suffer injuries due to a collision currently wait months for a simple claim to be resolved and can wait years for claims related to more serious and life-changing injuries to addressed. Additionally, the medical and financial benefits they receive often expire before they’re fully recovered.

Under the new system, Albertans who suffer catastrophic injuries will receive treatment and care for the rest of their lives. Those who sustain serious injuries will receive treatment until they are fully recovered. These changes mirror and build upon the Saskatchewan insurance model, where at-fault drivers can be sued for pain and suffering damages if they are convicted of a criminal offence, such as impaired driving or dangerous driving, or conviction of certain offenses under the Traffic Safety Act.

Work on this new auto insurance system will require legislation in the spring of 2025. In order to reconfigure auto insurance policies for 3.4 million Albertans, auto insurance companies need time to create and implement the new system. Alberta’s government expects the new system to be fully implemented by January 2027.

In the interim, starting in January 2025, the good driver rate cap will be adjusted to a 7.5% increase due to high legal costs, increasing vehicle damage repair costs and natural disaster costs. This protects good drivers from significant rate increases while ensuring that auto insurance providers remain financially viable in Alberta.

Albertans have been clear that they still want premiums to be based on risk. Bad drivers will continue to pay higher premiums than good drivers.

By providing significantly enhanced medical, rehabilitation and income support benefits, this system supports Albertans injured in collisions while reducing the impact of litigation costs on the amount that Albertans pay for their insurance.

“Keeping more money in Albertans’ pockets is one of the best ways to address the rising cost of living. This shift to a care-first automobile insurance system will do just that by helping lower premiums for people across the province.”

Quick facts

- Alberta’s government commissioned two auto insurance reports, which showed that legal fees and litigation costs tied to the province’s current system significantly increase premiums.

- A 2023 report by MNP shows

Alberta

Alberta fiscal update: second quarter is outstanding, challenges ahead

Alberta maintains a balanced budget while ensuring pressures from population growth are being addressed.

Alberta faces rising risks, including ongoing resource volatility, geopolitical instability and rising pressures at home. With more than 450,000 people moving to Alberta in the last three years, the province has allocated hundreds of millions of dollars to address these pressures and ensure Albertans continue to be supported. Alberta’s government is determined to make every dollar go further with targeted and responsible spending on the priorities of Albertans.

The province is forecasting a $4.6 billion surplus at the end of 2024-25, up from the $2.9 billion first quarter forecast and $355 million from budget, due mainly to higher revenue from personal income taxes and non-renewable resources.

Given the current significant uncertainty in global geopolitics and energy markets, Alberta’s government must continue to make prudent choices to meet its responsibilities, including ongoing bargaining for thousands of public sector workers, fast-tracking school construction, cutting personal income taxes and ensuring Alberta’s surging population has access to high-quality health care, education and other public services.

“These are challenging times, but I believe Alberta is up to the challenge. By being intentional with every dollar, we can boost our prosperity and quality of life now and in the future.”

Midway through 2024-25, the province has stepped up to boost support to Albertans this fiscal year through key investments, including:

- $716 million to Health for physician compensation incentives and to help Alberta Health Services provide services to a growing and aging population.

- $125 million to address enrollment growth pressures in Alberta schools.

- $847 million for disaster and emergency assistance, including:

- $647 million to fight the Jasper wildfires

- $163 million for the Wildfire Disaster Recovery Program

- $5 million to support the municipality of Jasper (half to help with tourism recovery)

- $12 million to match donations to the Canadian Red Cross

- $20 million for emergency evacuation payments to evacuees in communities impacted by wildfires

- $240 million more for Seniors, Community and Social Services to support social support programs.

Looking forward, the province has adjusted its forecast for the price of oil to US$74 per barrel of West Texas Intermediate. It expects to earn more for its crude oil, with a narrowing of the light-heavy differential around US$14 per barrel, higher demand for heavier crude grades and a growing export capacity through the Trans Mountain pipeline. Despite these changes, Alberta still risks running a deficit in the coming fiscal year should oil prices continue to drop below $70 per barrel.

After a 4.4 per cent surge in the 2024 census year, Alberta’s population growth is expected to slow to 2.5 per cent in 2025, lower than the first quarter forecast of 3.2 per cent growth because of reduced immigration and non-permanent residents targets by the federal government.

Revenue

Revenue for 2024-25 is forecast at $77.9 billion, an increase of $4.4 billion from Budget 2024, including:

- $16.6 billion forecast from personal income taxes, up from $15.6 billion at budget.

- $20.3 billion forecast from non-renewable resource revenue, up from $17.3 billion at budget.

Expense

Expense for 2024-25 is forecast at $73.3 billion, an increase of $143 million from Budget 2024.

Surplus cash

After calculations and adjustments, $2.9 billion in surplus cash is forecast.

- $1.4 billion or half will pay debt coming due.

- The other half, or $1.4 billion, will be put into the Alberta Fund, which can be spent on further debt repayment, deposited into the Alberta Heritage Savings Trust Fund and/or spent on one-time initiatives.

Contingency

Of the $2 billion contingency included in Budget 2024, a preliminary allocation of $1.7 billion is forecast.

Alberta Heritage Savings Trust Fund

The Alberta Heritage Savings Trust Fund grew in the second quarter to a market value of $24.3 billion as of Sept. 30, 2024, up from $23.4 billion at the end of the first quarter.

- The fund earned a 3.7 per cent return from July to September with a net investment income of $616 million, up from the 2.1 per cent return during the first quarter.

Debt

Taxpayer-supported debt is forecast at $84 billion as of March 31, 2025, $3.8 billion less than estimated in the budget because the higher surplus has lowered borrowing requirements.

- Debt servicing costs are forecast at $3.2 billion, down $216 million from budget.

Related information

-

Brownstone Institute2 days ago

Brownstone Institute2 days agoThe Most Devastating Report So Far

-

Business2 days ago

Business2 days agoCarbon tax bureaucracy costs taxpayers $800 million

-

ESG1 day ago

ESG1 day agoCan’t afford Rent? Groceries for your kids? Trudeau says suck it up and pay the tax!

-

Daily Caller1 day ago

Daily Caller1 day agoLos Angeles Passes ‘Sanctuary City’ Ordinance In Wake Of Trump’s Deportation Plan

-

John Stossel1 day ago

John Stossel1 day agoGreen Energy Needs Minerals, Yet America Blocks New Mines

-

Alberta1 day ago

Alberta1 day agoProvince considering new Red Deer River reservoir east of Red Deer

-

MAiD2 days ago

MAiD2 days agoOver 40% of people euthanized in Ontario lived in poorest parts of the province: government data

-

Addictions1 day ago

Addictions1 day agoBC Addictions Expert Questions Ties Between Safer Supply Advocates and For-Profit Companies