Economy

Politics the only consistency in carbon tax policy

From the Frontier Centre for Public Policy

By Lee Harding

Never mind that there is no easy connection between CO2 and temperatures, except in […]

The misplaced idea that carbon dioxide is pollution undergirds the dubious concept of the carbon tax. Never mind that there is no easy connection between CO2 and temperatures, except in the easily questioned computer models created by climate change proponents. Nevertheless, the carbon tax policy is the signature climate change policy of the Trudeau Government. This tax has raised energy prices across the country and supercharged inflation without any impact on reducing harmless carbon dioxide emissions.

The main impact of the carbon tax is to reduce of everybody’s living standards just a bit more each year. Finally, it seems to have succeeded in doing something else: undermining Liberal support. The awkward attempt to solve this political and policy problem sent federal arguments for the carbon tax into complete contradiction last week.

On October 26 Prime Minister Justin Trudeau announced a three-year moratorium on carbon taxes for home heating oil, a move that was good politics but curious policy.

“We’ve heard clearly from Atlantic Canadians through our amazing Atlantic MPs that since the federal pollution price came into force … certain features of that pollution price needed adjusting to work for everyone,” said Trudeau.

You see, last July Atlantic provinces had to give Ottawa worthy proposals to keep themselves out of Ottawa’s carbon pricing scheme. They failed, so their citizens have felt the pinch. Forty percent of Atlantic Canadians, but only three percent of all Canadians use fuel oil.

This reality facilitated a political solution–a national policy with mostly regional consequences for Liberal support. The problem was how to spin it.

“We are doubling down on our fight against climate change and…supporting Canadians while we fight climate change,” the PM said.

“Economists and experts around the world have long known that putting a price on carbon emissions is the best way to drive down those emissions that cause climate change, is the cheapest, most efficient and most impactful way and it’s working,” the PM insisted.

This circle can’t be squared, except politically. The fuel oil announcement was made hours before Conservative Leader Pierre Poilievre held his scheduled “Axe the Tax” rally against carbon taxes in Windsor, N.S., the riding of Liberal Atlantic Caucus chair Kody Blois.

Put together, this is a national but regional policy to adjust a carbon tax that works but does not work. It’s doubtful that taxes or grants will change the weather, of course, but fuel oil was unworthy of an exemption.

The heat output per gallon of fuel oil is 138,690 British Thermal Units and almost equal to that of natural gas (139,050 BTU). However, natural gas only produces 117 lbs of CO2 per million BTU, whereas distillate fuel oil produces more than 160 lbs. The worst “polluters” just got a break.

Meanwhile, residents west of Quebec, where natural gas use ranges from 49 to 77 per cent, will pay carbon taxes, as they always have–and more so as they increase every April. It’s moves like this that have allowed a federal government to maintain power that hasn’t won the popular vote since 2015.

Poilievre’s plan to end the carbon tax is a winner for policy sanity.

Lee Harding is a Research Fellow at the Frontier Centre for Public Policy.

Business

Saskatchewan becomes first Canadian province to fully eliminate carbon tax

From LifeSiteNews

Saskatchewan has become the first Canadian province to free itself entirely of the carbon tax.

On March 27, Saskatchewan Premier Scott Moe announced the removal of the provincial industrial carbon tax beginning April 1, boosting the province’s industry and making Saskatchewan the first carbon tax free province.

Under Moe’s direction, Saskatchewan has dropped the industrial carbon tax which he says will allow Saskatchewan to thrive under a “tariff environment.”

“I would hope that all of the parties running in the federal election would agree with those objectives and allow the provinces to regulate in this area without imposing the federal backstop,” he continued.

The removal of the tax is estimated to save Saskatchewan residents up to 18 cents a liter in gas prices.

The removal of the tax will take place on April 1, the same day the consumer carbon tax will reduce to 0 percent under Prime Minister Mark Carney’s direction. Notably, Carney did not scrap the carbon tax legislation: he just reduced its current rate to zero. This means it could come back at any time.

Furthermore, while Carney has dropped the consumer carbon tax, he has previously revealed that he wishes to implement a corporation carbon tax, the effects of which many argued would trickle down to all Canadians.

The Saskatchewan Association of Rural Municipalities (SARM) celebrated Moe’s move, noting that the carbon tax was especially difficult on farmers.

“I think the carbon tax has been in place for approximately six years now coming up in April and the cost keeps going up every year,” SARM president Bill Huber said.

“It puts our farming community and our business people in rural municipalities at a competitive disadvantage, having to pay this and compete on the world stage,” he continued.

“We’ve got a carbon tax on power — and that’s going to be gone now — and propane and natural gas and we use them more and more every year, with grain drying and different things in our farming operations,” he explained.

“I know most producers that have grain drying systems have three-phase power. If they haven’t got natural gas, they have propane to fire those dryers. And that cost goes on and on at a high level, and it’s made us more noncompetitive on a world stage,” Huber decalred.

The carbon tax is wildly unpopular and blamed for the rising cost of living throughout Canada. Currently, Canadians living in provinces under the federal carbon pricing scheme pay $80 per tonne.

2025 Federal Election

Fight against carbon taxes not over yet

As the federal government removes the consumer carbon tax, the Canadian Taxpayers Federation is calling on all party leaders to oppose all carbon taxes, including the hidden tax on business.

“Canadians fought hard to force Ottawa to back down on its consumer carbon tax and now the fight moves to stopping the hidden carbon tax on business,” said Franco Terrazzano, CTF Federal Director. “Canadians can’t afford a carbon tax on business that pushes up prices at the gas station and makes it harder for our businesses to compete while they’re already struggling with a trade war.”

Today, the federal government cut the consumer carbon tax rate to $0. This will reduce taxes by about 17 cents per litre of gasoline, 21 cents per litre of diesel and 15 cents per cubic metre of natural gas.

The federal government still imposes an industrial carbon tax on oil and gas, steel and fertilizer businesses, among others.

During the Liberal Party leadership race, Prime Minister Mark Carney said he would “improve and tighten” the industrial carbon tax and “extend the framework to 2035.”

Just 12 per cent of Canadians believe businesses pay most of the cost of the industrial carbon tax, according to a Leger poll commissioned by the CTF. Meanwhile, 70 per cent said businesses would pass most or some carbon tax costs on to consumers.

Conservative Party Leader Pierre Poilievre said he will “repeal the entire carbon tax law, including the tax on Canadian businesses and industries.”

“Carbon taxes on refineries make gas more expensive, carbon taxes on utilities make home heating more expensive and carbon taxes on fertilizer plants increase costs for farmers and that makes groceries more expensive,” Terrazzano said. “Canadians know Poilievre will end all carbon taxes and Canadians know Carney’s carbon tax costs won’t be zero.

“Carney owes Canadians a clear answer: How much will your carbon tax cost?”

-

2025 Federal Election2 days ago

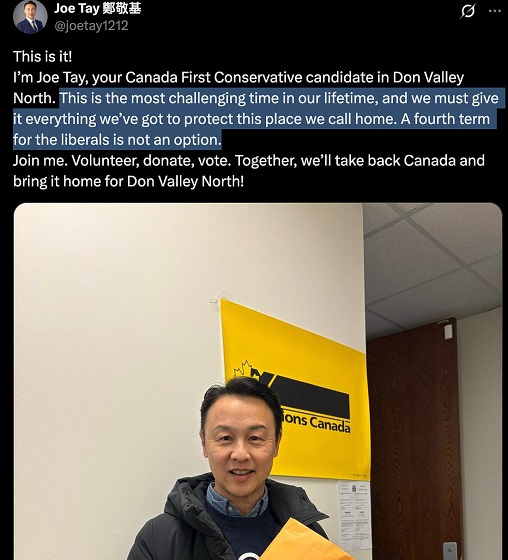

2025 Federal Election2 days agoJoe Tay Says He Contacted RCMP for Protection, Demands Carney Fire MP Over “Bounty” Remark

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoHong Kong-Canadian Groups Demand PM Carney Drop Liberal Candidate Over “Bounty” Remark Supporting CCP Repression

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPoilievre To Create ‘Canada First’ National Energy Corridor

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoAlcohol tax and MP pay hike tomorrow (April 1)

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoChina Election Interference – Parties Received Security Briefing Days Ago as SITE Monitors Threats to Conservative Candidate Joe Tay

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoFixing Canada’s immigration system should be next government’s top priority

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPoilievre, Conservatives receive election endorsement from large Canadian trade union

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoAre the Jays Signing Or Declining? Only Vladdy & Bo Know For Sure