Alberta

Cases against Ty Northcott Rodeo and Alberta pastors expected to crumble as court rules public health orders violated Charter rights

Alberta court strikes down public health orders that violated Charter freedoms

From the Justice Centre for Constitutional Freedoms

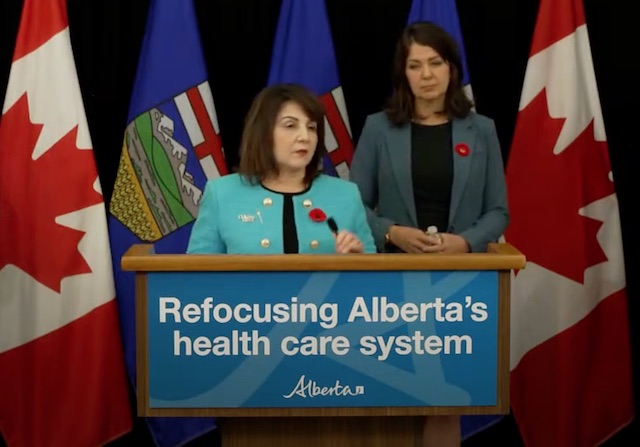

CALGARY, ALBERTA: The Justice Centre for Constitutional Freedoms is pleased with the Court of King’s Bench of Alberta’s decision to invalidate the public health orders of Dr. Deena Hinshaw, Chief Medical Officer of Health (CMOH), in Ingram v. Alberta. The court struck down these lockdown measures because they were effectively issued by Cabinet rather than by the CMOH. Dr. Hinshaw testified at trial that politicians were the final decision-making authority, and that she merely provided advice and recommendations.

With these health orders having been invalidated, it is expected that Crown prosecutors will need to withdraw charges against Ty Northcott/ Northcott Rodeo Inc., Pastor James Coates of Grace Life Church of Edmonton, Pastor Tim Stephens’ church, Fairview Baptist Church, and others.

The court’s ruling also confirms that lockdowns did violate Albertans’ fundamental freedoms of conscience, religion, association, and peaceful assembly protected in the Canadian Charter of Rights and Freedoms. In this court action, the Alberta government produced no comprehensive studies, reports or data analyzing lockdown harms. Without any comprehensive cost-benefit analysis, Justice Barbara Romaine nevertheless concluded that lockdowns were justified violations of Charter freedoms because they produced more good than harm.

Using the slogan “two weeks to flatten the curve,” the Alberta Government first declared a public health emergency in March of 2020, after which various Charter rights and freedoms were violated during the next two years. When Rebecca Ingram and other applicants filed their court action in December of 2020, the Alberta government had already been restricting Albertans’ rights to associate freely, assemble peacefully, and practice their religious beliefs for almost nine months. This was the first court challenge to lockdown measures in Alberta. In spite of Charter freedoms having already been violated for almost nine months, the court granted the Alberta government’s request to delay presenting its evidence until July of 2022.

In April 2022, Dr. Deena Hinshaw was cross-examined about what expert information she had at the time that these public health decisions were being determined. Dr. Hinshaw was specifically asked whether she was aware of any evidence of harms to elementary school children from being compelled to wear masks. Under oath, Dr. Hinshaw said no. Yet the court’s ruling in another case, C.M. v. Alberta, has revealed that Dr. Hinshaw did receive information about how children could be harmed by mandatory mask-wearing. A February 7, 2022 memo sent to Premier Jason Kenney, on which Dr. Hinshaw was copied, stated that masks can disrupt learning and interfere with children’s social, emotional, and speech development by impairing verbal and non-verbal communication, emotional signaling and facial recognition. Nevertheless, the Court dismissed an interlocutory application to compel Dr. Deena Hinshaw to re-attend court for further cross-examination.

“Significant injustice has taken place in the past three years under these draconian public health measures. We are hopeful this ruling will mean the withdrawal of charges against Pastor James Coates, Fairview Baptist Church, Ty Northcott, and other courageous citizens who refused to comply with unjust and utterly unscientific measures,” states John Carpay, President of the Justice Centre.

Alberta

Alberta’s fiscal update projects budget surplus, but fiscal fortunes could quickly turn

From the Fraser Institute

By Tegan Hill

According to the recent mid-year update tabled Thursday, the Smith government projects a $4.6 billion surplus in 2024/25, up from the $2.9 billion surplus projected just a few months ago. Despite the good news, Premier Smith must reduce spending to avoid budget deficits.

The fiscal update projects resource revenue of $20.3 billion in 2024/25. Today’s relatively high—but very volatile—resource revenue (including oil and gas royalties) is helping finance today’s spending and maintain a balanced budget. But it will not last forever.

For perspective, in just the last decade the Alberta government’s annual resource revenue has been as low as $2.8 billion (2015/16) and as high as $25.2 billion (2022/23).

And while the resource revenue rollercoaster is currently in Alberta’s favor, Finance Minister Nate Horner acknowledges that “risks are on the rise” as oil prices have dropped considerably and forecasters are projecting downward pressure on prices—all of which impacts resource revenue.

In fact, the government’s own estimates show a $1 change in oil prices results in an estimated $630 million revenue swing. So while the Smith government plans to maintain a surplus in 2024/25, a small change in oil prices could quickly plunge Alberta back into deficit. Premier Smith has warned that her government may fall into a budget deficit this fiscal year.

This should come as no surprise. Alberta’s been on the resource revenue rollercoaster for decades. Successive governments have increased spending during the good times of high resource revenue, but failed to rein in spending when resource revenues fell.

Previous research has shown that, in Alberta, a $1 increase in resource revenue is associated with an estimated 56-cent increase in program spending the following fiscal year (on a per-person, inflation-adjusted basis). However, a decline in resource revenue is not similarly associated with a reduction in program spending. This pattern has led to historically high levels of government spending—and budget deficits—even in more recent years.

Consider this: If this fiscal year the Smith government received an average level of resource revenue (based on levels over the last 10 years), it would receive approximately $13,000 per Albertan. Yet the government plans to spend nearly $15,000 per Albertan this fiscal year (after adjusting for inflation). That’s a huge gap of roughly $2,000—and it means the government is continuing to take big risks with the provincial budget.

Of course, if the government falls back into deficit there are implications for everyday Albertans.

When the government runs a deficit, it accumulates debt, which Albertans must pay to service. In 2024/25, the government’s debt interest payments will cost each Albertan nearly $650. That’s largely because, despite running surpluses over the last few years, Albertans are still paying for debt accumulated during the most recent string of deficits from 2008/09 to 2020/21 (excluding 2014/15), which only ended when the government enjoyed an unexpected windfall in resource revenue in 2021/22.

According to Thursday’s mid-year fiscal update, Alberta’s finances continue to be at risk. To avoid deficits, the Smith government should meaningfully reduce spending so that it’s aligned with more reliable, stable levels of revenue.

Author:

Alberta

Premier Smith says Auto Insurance reforms may still result in a publicly owned system

Better, faster, more affordable auto insurance

Alberta’s government is introducing a new auto insurance system that will provide better and faster services to Albertans while reducing auto insurance premiums.

After hearing from more than 16,000 Albertans through an online survey about their priorities for auto insurance policies, Alberta’s government is introducing a new privately delivered, care-focused auto insurance system.

Right now, insurance in the province is not affordable or care focused. Despite high premiums, Albertans injured in collisions do not get the timely medical care and income support they need in a system that is complex to navigate. When fully implemented, Alberta’s new auto insurance system will deliver better and faster care for those involved in collisions, and Albertans will see cost savings up to $400 per year.

“Albertans have been clear they need an auto insurance system that provides better, faster care and is more affordable. When it’s implemented, our new privately delivered, care-centred insurance system will put the focus on Albertans’ recovery, providing more effective support and will deliver lower rates.”

“High auto insurance rates put strain on Albertans. By shifting to a system that offers improved benefits and support, we are providing better and faster care to Albertans, with lower costs.”

Albertans who suffer injuries due to a collision currently wait months for a simple claim to be resolved and can wait years for claims related to more serious and life-changing injuries to addressed. Additionally, the medical and financial benefits they receive often expire before they’re fully recovered.

Under the new system, Albertans who suffer catastrophic injuries will receive treatment and care for the rest of their lives. Those who sustain serious injuries will receive treatment until they are fully recovered. These changes mirror and build upon the Saskatchewan insurance model, where at-fault drivers can be sued for pain and suffering damages if they are convicted of a criminal offence, such as impaired driving or dangerous driving, or conviction of certain offenses under the Traffic Safety Act.

Work on this new auto insurance system will require legislation in the spring of 2025. In order to reconfigure auto insurance policies for 3.4 million Albertans, auto insurance companies need time to create and implement the new system. Alberta’s government expects the new system to be fully implemented by January 2027.

In the interim, starting in January 2025, the good driver rate cap will be adjusted to a 7.5% increase due to high legal costs, increasing vehicle damage repair costs and natural disaster costs. This protects good drivers from significant rate increases while ensuring that auto insurance providers remain financially viable in Alberta.

Albertans have been clear that they still want premiums to be based on risk. Bad drivers will continue to pay higher premiums than good drivers.

By providing significantly enhanced medical, rehabilitation and income support benefits, this system supports Albertans injured in collisions while reducing the impact of litigation costs on the amount that Albertans pay for their insurance.

“Keeping more money in Albertans’ pockets is one of the best ways to address the rising cost of living. This shift to a care-first automobile insurance system will do just that by helping lower premiums for people across the province.”

Quick facts

- Alberta’s government commissioned two auto insurance reports, which showed that legal fees and litigation costs tied to the province’s current system significantly increase premiums.

- A 2023 report by MNP shows

-

ESG2 days ago

ESG2 days agoCan’t afford Rent? Groceries for your kids? Trudeau says suck it up and pay the tax!

-

John Stossel2 days ago

John Stossel2 days agoGreen Energy Needs Minerals, Yet America Blocks New Mines

-

Daily Caller2 days ago

Daily Caller2 days agoLos Angeles Passes ‘Sanctuary City’ Ordinance In Wake Of Trump’s Deportation Plan

-

Alberta2 days ago

Alberta2 days agoProvince considering new Red Deer River reservoir east of Red Deer

-

Addictions2 days ago

Addictions2 days agoBC Addictions Expert Questions Ties Between Safer Supply Advocates and For-Profit Companies

-

Aristotle Foundation1 day ago

Aristotle Foundation1 day agoToronto cancels history, again: The irony and injustice of renaming Yonge-Dundas Square to Sankofa Square

-

conflict1 day ago

conflict1 day agoUS and UK authorize missile strikes into Russia, but are we really in danger of World War III?

-

armed forces1 day ago

armed forces1 day agoJudge dismisses Canadian military personnel’s lawsuit against COVID shot mandate