Alberta

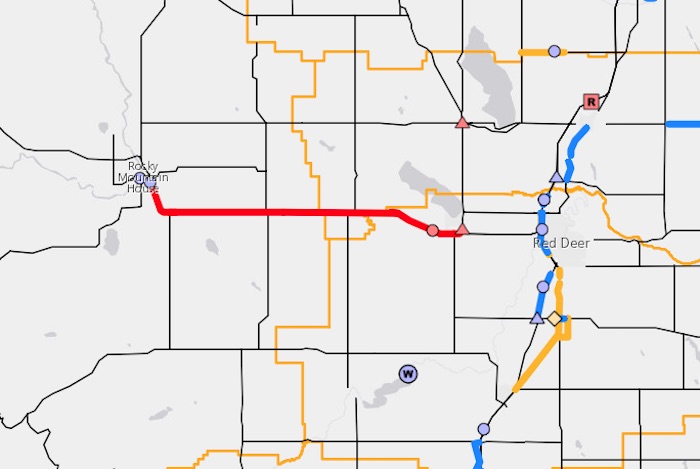

Alberta 2023 budget plows ahead with twinning highway 11 from Sylvan Lake to Rocky Mountain House

Building Alberta’s economic corridor network

Budget 2023 includes strategic investments in Alberta’s highway network to build economic corridors, creating jobs, improving safety and supporting economic development.

Budget 2023 includes $8 billion for the Ministry of Transportation and Economic Corridors’ three-year capital plan, a $718-million increase compared with Budget 2022.

“Budget 2023 is focused on securing Alberta’s future by growing the economy. Our investments will enhance economic corridors that provide vital links to markets in and out of Alberta, helping our industries expand and succeed. These projects will increase the safety and efficiency of our provincial highway network, improving travel for Albertans and commercial carriers in key industries.”

The total capital investment is $2 billion for planning, design and construction of major highway and bridge projects. This work focuses on improving traffic flow and supporting investments in the province’s major trade corridors. Examples of projects across the province that are receiving funding include the Calgary and Edmonton ring roads, Highway 3 twinning, Highway 11 twinning, and replacing the Highway 2 and Highway 556 interchange at Balzac. This capital investment funding also includes $75.5 million over three years for 23 engineering or planning projects to address known future needs.

“Budget 2023 is investing in Alberta drivers through improvements to Highway 60 through Acheson. These improvements will help families save time on their commute while improving the efficient movement of goods across the province. Budget 2023 also responds to safety concerns from the community with a new intersection at Highway 16A and Range Road 20 in Parkland County. The new intersection will not only help area residents get to and from home safely but will also improve traffic flow along this major economic corridor.”

“Highway 63, north of Fort McMurray, is a critical link in northern Alberta for oversize and overweight vehicles transporting goods for the energy sector. Twinning this highway will improve efficiency and safety for both commercial drivers and commuters. It also enables oilsands workers to more easily commute from Fort McMurray, which we know provides a healthier lifestyle for them and their families as opposed to flying from out of province and living in a camp. The workers who decide to make this move will see the benefits of living in such an amazing province like Alberta.”

“Alberta’s Industrial Heartland Association is pleased that the 55-year-old Vinca Bridge replacement is included in the Government of Alberta’s 2023 budget. As a vital component of Alberta’s high-load corridor and a strategic connector in Alberta’s Industrial Heartland, the bridge services a thriving industrial zone with over $45 billion in total capital investment and billions more expected in the coming years. Replacing Vinca Bridge will shorten travel times, reduce greenhouse gas emissions and enhance the competitiveness of both the Industrial Heartland and the manufacturing supply chain that contributes to its success.”

“We have been advocating hard for twinning and rail grade separation for Highway 60, and we are pleased to see this commitment from the Government of Alberta. Acheson is not only the beating, industrial heart of Parkland County, it is one of the largest industrial areas in Western Canada. Completing this work in a timely matter will improve access and movement along Highway 60 and allow for further development in Acheson, which will contribute to economic growth and job creation throughout Parkland County and the Edmonton region.”

“Representing hundreds of businesses in the Acheson area, the Acheson Business Association is thrilled with and would like to thank the Government of Alberta for this latest announcement for the twinning and rail grade separation for Highway 60. Highway 60 is an important connector of arterial highways, allowing products to move all directions through the metro Edmonton area, and the twinning and overpass will create a safer route for employees, travellers and business owners who are passing through this stretch of road every day. This will also enable the region to continue to attract more investors and businesses by reducing delays and eliminating congestion along this major trade corridor.”

Budget 2023 also includes $1.7 billion over three years for capital maintenance and renewal, which extends the life of the province’s existing road and bridge network and helps industry create and maintain jobs. These investments will allow the province to maintain existing roads and bridges to support safe and efficient travel to benefit Albertans and the economy.

Transportation and Economic Corridors will also be providing $3.9 billion for capital grants to municipalities over the next three years. This includes maintaining the funding commitment to Calgary and Edmonton for their LRT projects and continuing to provide funding for the Strategic Transportation Infrastructure Program to help municipalities improve critical local transportation infrastructure. Ongoing investments in water and wastewater infrastructure programs will also ensure all Albertans have reliable access to clean drinking water and effective wastewater services.

Additionally, Budget 2023 will provide nearly $400 million to support building and repairing water management infrastructure that provides irrigation for the agriculture sector and flood mitigation for Alberta communities such as the Springbank Off-stream Reservoir.

Budget 2023 secures Alberta’s future by transforming the health-care system to meet people’s needs, supporting Albertans with the high cost of living, keeping our communities safe and driving the economy with more jobs, quality education and continued diversification.

Alberta

Is Canada’s Federation Fair?

David Clinton

David Clinton

Contrasting the principle of equalization with the execution

Quebec – as an example – happens to be sitting on its own significant untapped oil and gas reserves. Those potential opportunities include the Utica Shale formation, the Anticosti Island basin, and the Gaspé Peninsula (along with some offshore potential in the Gulf of St. Lawrence).

So Quebec is effectively being paid billions of dollars a year to not exploit their natural resources. That places their ostensibly principled stand against energy resource exploitation in a very different light.

You’ll need to search long and hard to find a Canadian unwilling to help those less fortunate. And, so long as we identify as members of one nation¹, that feeling stretches from coast to coast.

So the basic principle of Canada’s equalization payments – where poorer provinces receive billions of dollars in special federal payments – is easy to understand. But as you can imagine, it’s not easy to apply the principle in a way that’s fair, and the current methodology has arguably lead to a very strange set of incentives.

According to Department of Finance Canada, eligibility for payments is determined based on your province’s fiscal capacity. Fiscal capacity is a measure of the taxes (income, business, property, and consumption) that a province could raise (based on national average rates) along with revenues from natural resources. The idea, I suppose, is that you’re creating a realistic proxy for a province’s higher personal earnings and consumption and, with greater natural resources revenues, a reduced need to increase income tax rates.

But the devil is in the details, and I think there are some questions worth asking:

- Whichever way you measure fiscal capacity there’ll be both winners and losers, so who gets to decide?

- Should a province that effectively funds more than its “share” get proportionately greater representation for national policy² – or at least not see its policy preferences consistently overruled by its beneficiary provinces?

The problem, of course, is that the decisions that defined equalization were – because of long-standing political conditions – dominated by the region that ended up receiving the most. Had the formula been the best one possible, there would have been little room to complain. But was it?

For example, attaching so much weight to natural resource revenues is just one of many possible approaches – and far from the most obvious. Consider how the profits from natural resources already mostly show up in higher income and corporate tax revenues (including income tax paid by provincial government workers employed by energy-related ministries)?

And who said that such calculations had to be population-based, which clearly benefits Quebec (nine million residents vs around $5 billion in resource income) over Newfoundland (545,000 people vs $1.6 billion) or Alberta (4.2 million people vs $19 billion). While Alberta’s average market income is 20 percent or so higher than Quebec’s, Quebec’s is quite a bit higher than Newfoundland’s. So why should Newfoundland receive only minimal equalization payments?

To illustrate all that, here’s the most recent payment breakdown when measured per-capita:

|

For clarification, the latest per-capita payments to poorer provinces ranged from $3,936 to PEI, $1,553 to Quebec, and $36 to Ontario. Only Saskatchewan, Alberta, and BC received nothing.

And here’s how the total equalization payments (in millions of dollars) have played out over the past decade:

Is energy wealth the right differentiating factor because it’s there through simple dumb luck, morally compelling the fortunate provinces to share their fortune? That would be a really difficult argument to make. For one thing because Quebec – as an example – happens to be sitting on its own significant untapped oil and gas reserves. Those potential opportunities include the Utica Shale formation, the Anticosti Island basin, and the Gaspé Peninsula (along with some offshore potential in the Gulf of St. Lawrence).

So Quebec is effectively being paid billions of dollars a year to not exploit their natural resources. That places their ostensibly principled stand against energy resource exploitation in a very different light. Perhaps that stand is correct or perhaps it isn’t. But it’s a stand they probably couldn’t have afforded to take had the equalization calculation been different.

Of course, no formula could possibly please everyone, but punishing the losers with ongoing attacks on the very source of their contributions is guaranteed to inspire resentment. And that could lead to very dark places.

Note: I know this post sounds like it came from a grumpy Albertan. But I assure you that I’ve never even visited the province, instead spending most of my life in Ontario.

Which has admittedly been challenging since the former primer minister infamously described us as a post-national state without an identity.

This isn’t nearly as crazy as it sounds. After all, there are already formal mechanisms through which Indigenous communities get more than a one-person-one-vote voice.

Subscribe to The Audit.

For the full experience, upgrade your subscription.

Alberta

Big win for Alberta and Canada: Statement from Premier Smith

Premier Danielle Smith issued the following statement on the April 2, 2025 U.S. tariff announcement:

“Today was an important win for Canada and Alberta, as it appears the United States has decided to uphold the majority of the free trade agreement (CUSMA) between our two nations. It also appears this will continue to be the case until after the Canadian federal election has concluded and the newly elected Canadian government is able to renegotiate CUSMA with the U.S. administration.

“This is precisely what I have been advocating for from the U.S. administration for months.

“It means that the majority of goods sold into the United States from Canada will have no tariffs applied to them, including zero per cent tariffs on energy, minerals, agricultural products, uranium, seafood, potash and host of other Canadian goods.

“There is still work to be done, of course. Unfortunately, tariffs previously announced by the United States on Canadian automobiles, steel and aluminum have not been removed. The efforts of premiers and the federal government should therefore shift towards removing or significantly reducing these remaining tariffs as we go forward and ensuring affected workers across Canada are generously supported until the situation is resolved.

“I again call on all involved in our national advocacy efforts to focus on diplomacy and persuasion while avoiding unnecessary escalation. Clearly, this strategy has been the most effective to this point.

“As it appears the worst of this tariff dispute is behind us (though there is still work to be done), it is my sincere hope that we, as Canadians, can abandon the disastrous policies that have made Canada vulnerable to and overly dependent on the United States, fast-track national resource corridors, get out of the way of provincial resource development and turn our country into an independent economic juggernaut and energy superpower.”

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoMark Carney refuses to clarify 2022 remarks accusing the Freedom Convoy of ‘sedition’

-

Catherine Herridge1 day ago

Catherine Herridge1 day agoFBI imposed Hunter Biden laptop ‘gag order’ after employee accidentally confirmed authenticity: report

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoDon’t let the Liberals fool you on electric cars

-

International1 day ago

International1 day agoTrump’s ‘Golden Dome’ defense shield must be built now, Lt. Gen. warns

-

Crime1 day ago

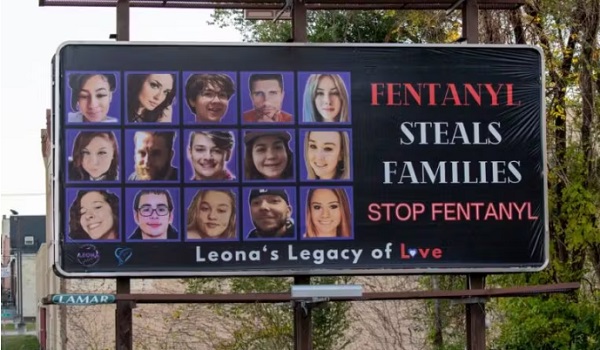

Crime1 day agoFirst Good Battlefield News From Trump’s Global War on Fentanyl

-

COVID-192 days ago

COVID-192 days agoMaxime Bernier slams Freedom Convoy leaders’ guilty verdict, calls Canada’s justice system ‘corrupt’

-

Courageous Discourse10 hours ago

Courageous Discourse10 hours agoEurope Had 127,350 Cases of Measles in 2024

-

Immigration2 days ago

Immigration2 days agoImmigrant background checks are unrelated to national security?