Opinion

Sports will bankrupt this city unless City Hall becomes more pro-active or take an activist role.

What is it about sports that needs bail outs and subsidies. The winter games will be costing us for years yet, with million-dollar payments to the college for the ice rink alone. The Westerner needed emergency bail outs to stay afloat. The CFR agreement needed a rewrite. Now the Riverbend Golf Course?

Recently I read in the news about conflicting goals at Riverbend Golf Course and the surrounding facilities like the trails and the waterpark.

The golf course wants a bigger club house, more bathrooms and parking for example. Then I hear that they have not been paying their debt from the last expansion in 2004, 18 years ago. As I understand it, they have only paid $125,000 of a $1.7 million dollar loan, about 7%.

The city has had council representation and citizen representation on the board, and yet this happens. The Westerner Grounds nearly bankrupted itself recently under similar circumstances. The city’s representative never questioned the status quo, just quietly accepted it.

Would the city accept me not paying my property taxes five out of every 6 years because I want to expand and add more bathrooms to my house?

My children and grandchildren went and are going to school, and we fundraise, sell things, working bingos, casinos, collect bottles and hold raffles. The hospitals where they were born fundraise, the SPCA fund raise.

When they entered sports like hockey, soccer, BMX, baseball, football etc. they hold raffles, have garage sales, bottle drives, sold coupons, meat, ice salt etc. to raise money.

Can the golf club follow suit to get out of being a drain on the public purse, while keeping their big dreams?

Our great city needs to look at their return on investments sometime. Instead of bail outs at the last minute every time. They need to be pro-active and not just reactive.

The city owns the land they could lease it to a private operator, perhaps make a return or at least reduce the costs to the taxpayers.

Perhaps, someone could just question things? Perhaps, the city could look at being more of an activist shareholder or appoint more activist representation?

Is it just easier to write cheques? I think the golf course will see this debt forgiven or rolled into a bigger loan for another expansion. After all, it is just the taxpayers’ money. Just saying.

Garfield Marks

2025 Federal Election

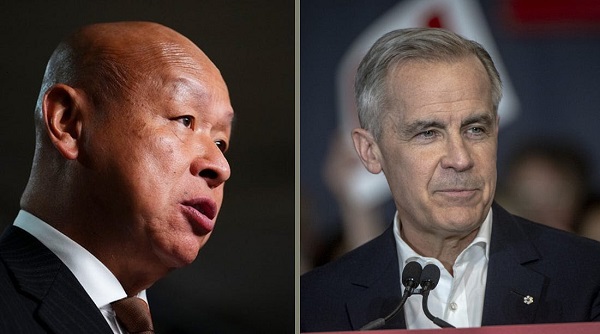

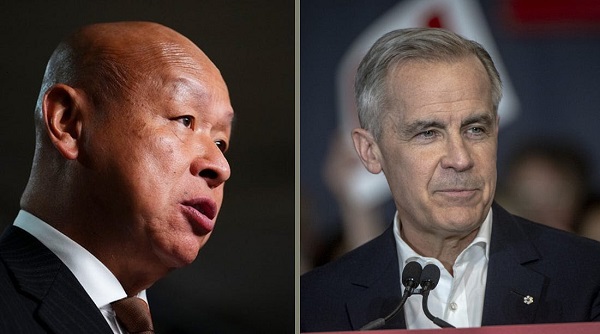

Liberal MP Paul Chiang Resigns Without Naming the Real Threat—The CCP

Dan Knight

Dan Knight

After parroting a Chinese bounty on a Canadian citizen, Chiang exits the race without once mentioning the regime behind it—opting instead to blame “distractions” and Donald Trump.

So Paul Chiang is gone. Stepped aside. Out of the race. And if you’re expecting a moment of reflection, an ounce of honesty, or even the basic decency to acknowledge what this was really about—forget it.

In his carefully scripted resignation statement, Chiang didn’t even mention the Chinese Communist Party. Not once. He echoed a foreign bounty placed on a Canadian citizen—Joe Tay—and he couldn’t even bring himself to name the regime responsible.

Instead, he talked about… Donald Trump. That’s right. He dragged Trump into a resignation about repeating CCP bounty threats. The guy who effectively told Canadians, “If you deliver a Conservative to the Chinese consulate, you can collect a reward,” now wants us to believe the real threat is Trump?

I haven’t seen Donald Trump put bounties on Canadian citizens. But Beijing has. And Chiang parroted it like a good little foot soldier—and then blamed someone who lives 2,000 miles away.

But here’s the part you can’t miss: Mark Carney let him stay.

Let’s not forget, Carney called Chiang’s comments “deeply offensive” and a “lapse in judgment”—and then said he was staying on as the candidate. It wasn’t until the outrage hit boiling point, the headlines stacked up, and groups like Hong Kong Watch got the RCMP involved, that Chiang bailed. Not because Carney made a decision—because the optics got too toxic.

And where is Carney now? Still refusing to disclose his financial assets. Still dodging questions about that $250 million loan from the Bank of China to the firm he chaired. Still giving sanctimonious speeches about “protecting democracy” while his own caucus parrots authoritarian propaganda.

If you think Chiang’s resignation fixes the problem, you’re missing the real issue. Because Chiang was just the symptom.

Carney is the disease.

He covered for it. He excused it. He enabled it. And now he wants to pose as the man who will stand up to foreign interference?

He can’t even stand up to it in his own party.

So no, we’re not letting this go. Chiang may be gone—but the stench is still in the room. And it’s wearing a tailored suit, smiling for the cameras, and calling itself “leader of the Liberal Party.”

Subscribe to The Opposition with Dan Knight .

For the full experience, upgrade your subscription.

2025 Federal Election

PM Carney’s Candidate Paul Chiang Steps Down After RCMP Confirms Probe Into “Bounty” Comments

Sam Cooper

Sam Cooper

Just after midnight Monday, Liberal MP Paul Chiang announced he is stepping down as the Liberal candidate in Markham–Unionville — hours after Canada’s federal police confirmed it was “looking into” allegations that he endorsed handing a political rival to a foreign government in exchange for a bounty.

“This is a uniquely important election with so much at stake for Canadians,” Chiang wrote in a late-night statement. “I do not want there to be distractions in this critical moment. That’s why I’m standing aside as our 2025 candidate.”

The announcement followed a day of escalating controversy, triggered by The Bureau’s Friday report and a series of breaking developments over the weekend and Monday, detailing Chiang’s remarks at a January meeting with Chinese-language media.

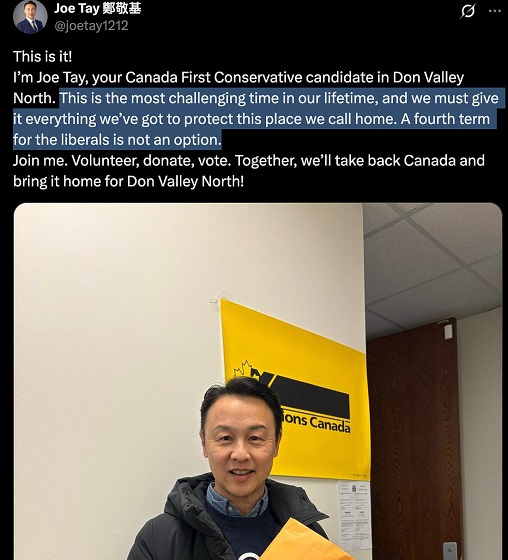

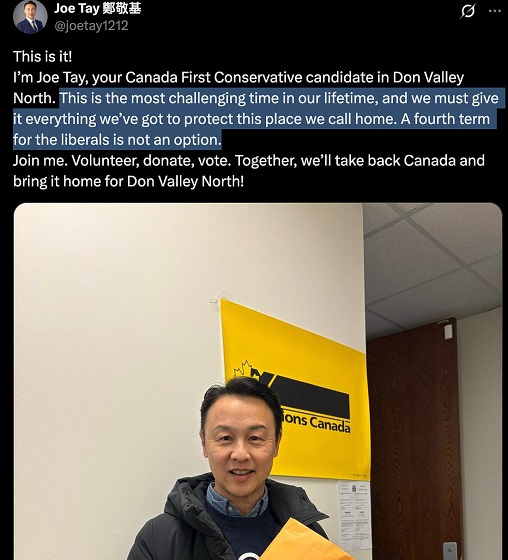

At a January news conference with Chinese-language media, Chiang suggested that Joe Tay’s criminal charge in Hong Kong would create a “great controversy” if he were elected to Parliament, according to the Ming Pao newspaper. He then reportedly crossed into territory that Hong Kong rights groups have asked the RCMP to investigate — potentially amounting to counselling kidnapping and violating Canada’s foreign interference laws — by suggesting that Tay, a Canadian citizen wanted under Hong Kong’s National Security Law, could be “taken” to the Chinese Consulate in Toronto to claim a HK$1 million bounty.

The UK-based human rights NGO Hong Kong Watch filed a formal letter to RCMP Commissioner Mike Duheme on Monday morning, requesting a criminal investigation. The letter alleged Chiang’s comments may amount to “counselling to commit kidnapping” under Canada’s Criminal Code, and potentially violate the new Foreign Interference and Security of Information Act.

By late evening, the RCMP confirmed it was “looking into the matter,” citing the serious and growing threat of foreign interference and transnational repression. While no criminal charges have been laid, and no details about potential protective measures have been released, the federal police said it is working closely with intelligence and law enforcement partners.

Chiang did not reference the controversy directly in his resignation statement, instead framing his decision as a step to protect the broader interests of the Liberal campaign. He expressed pride in his record and gratitude to his community.

“For the past three-and-a-half years, it has been the greatest honour of my life to serve the people of Markham–Unionville as their Member of Parliament,” he wrote. “Every single day, I served with integrity and worked to deliver results.”

The move comes after mounting calls for Chiang’s removal, including from more than 40 Hong Kong diaspora groups and international human rights advocates who said his remarks endorsed Beijing’s tactics of transnational repression. Joe Tay, the Conservative candidate targeted in the remarks, revealed Monday that he had contacted the RCMP for personal protection even before the comments were made public.

Chiang had previously apologized for what he called a “terrible lapse in judgment,” but had retained the backing of Prime Minister Mark Carney — until Monday night.

More to come on this breaking story.

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoJoe Tay Says He Contacted RCMP for Protection, Demands Carney Fire MP Over “Bounty” Remark

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoHong Kong-Canadian Groups Demand PM Carney Drop Liberal Candidate Over “Bounty” Remark Supporting CCP Repression

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoAlcohol tax and MP pay hike tomorrow (April 1)

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoWelcome to Britain, Where Critical WhatsApp Messages Are a Police Matter

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPoilievre To Create ‘Canada First’ National Energy Corridor

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoChina Election Interference – Parties Received Security Briefing Days Ago as SITE Monitors Threats to Conservative Candidate Joe Tay

-

2025 Federal Election2 days ago

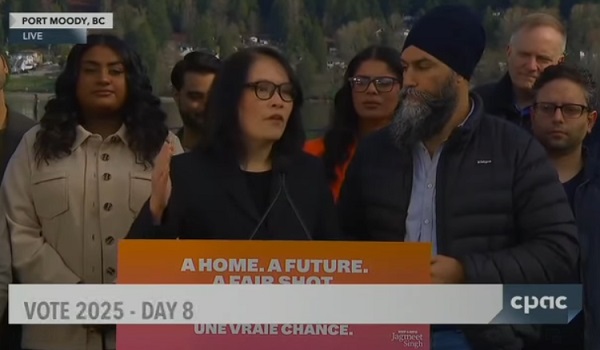

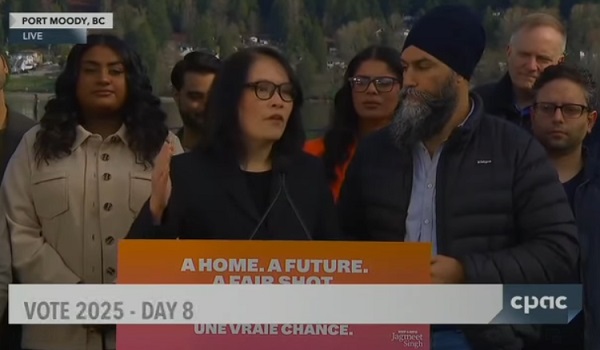

2025 Federal Election2 days agoChinese Election Interference – NDP reaction to bounty on Conservative candidate

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoFixing Canada’s immigration system should be next government’s top priority