Alberta

More dollars going into classrooms to support today’s students

Staffing projections show up to 1,600 more teachers and support staff will be hired in the upcoming school year. Alberta’s government is also providing school authorities additional funding to support higher salaries for teachers, address enrolment growth and support francophone education.

More staff in schools

School authorities are projecting up to 800 more teachers and principals will be hired in the upcoming school year. This represents an increase of 2.2 per cent from the certificated staff in the 2021/22 school year and means more teachers in the classroom supporting Alberta’s students.

Additionally, an increase of approximately 800 support staff is also expected. This includes classroom-based educational and teacher assistants and represents an increase of 3.1 per cent from the previous school year.

“I’m thrilled to see more teachers and educational assistants will be hired in the coming school year. Alberta’s school board reserve policy has played an important role in directing today’s education dollars towards today’s students.”

Funding to support higher salaries for teachers

Alberta’s government is also providing up to an additional $50 million in 2022/23 to cover recently ratified bargaining agreements with teachers. By funding these agreements, Alberta’s government is further ensuring stability for school authorities.

“ASBA appreciates that the government will provide funding for the recently ratified teacher bargaining agreements in addition to providing targeted supports for enrolment growth as school boards face rapidly increasing student populations. This funding will help offset pressures and enable boards to address operational needs while they continue to make informed decisions in support of students and their local school communities across Alberta.”

“ASBOA welcomes the commitment to fund teacher collective agreements, and the additional funding to support enrolment growth and francophone education in Alberta. This announcement provides greater funding certainty for publicly funded education as we are about to start a new school year.”

Additional funding for enrolment growth

More than $7 million in additional funding will be provided to school authorities through a new enrolment growth grant. Early childhood services (ECS) operators will also receive support if they see significant enrolment increases.

The funding available through this new supplemental enrolment growth grant provides for additional student funding for authority enrolment growth above a set threshold, with higher rates for more growth.

“While the CASS Board of Directors recognizes that the current funding formula softens the impact of enrollment decline, we are pleased to see that this announcement will allow divisions to better meet their needs when addressing significant enrollment growth.”

“The Association of Independent Schools & Colleges in Alberta appreciates the additional funding that is being allocated to school authorities that are seeing significant growth. The Supplemental Enrollment Grant will allow schools to better meet the needs of a growing student population, and ensure their students receive an educational experience that prepares them for future success.”

Redesigned grant for francophone school authorities

About $5 million in additional funding will be provided to francophone school boards through an updated francophone equivalency grant. This increased investment means that in the 2022/23 school year, Alberta Education will allocate $7 million to francophone school authorities to support francophone education in Alberta.

“The Fédération des conseils scolaires francophones de l’Alberta welcomes the announcement of an adjustment to school funding to better meet the needs of francophone students in the province. We appreciate the collaborative work that has taken place over the past few months to make the challenges faced by francophone school boards heard. Their reality is unique and the response to their challenges must, by that very fact, be unique.”

Quick facts

- Increased staffing levels will be supported by the use of operating reserves in the 2022/23 school year.

- The Minister of Education recently approved 64 requests to use operating reserves for the 2022/23 school year. This included $88 million in requests for reserves to be spent on staffing, instruction and educational assistants.

- By the end of the 2022/23 school year, maximum operating reserve amounts will be set for school boards, as described in the Funding Manual for School Authorities to ensure public dollars go to educational purposes in the same year the funding is provided.

- The limit on allowable reserve balances was signaled to school jurisdictions with the new funding model in 2020.

- School authorities will also receive additional funding from the province to support higher than expected fuel costs, while monthly average diesel prices exceed $1.25 per litre.

Alberta

Federal taxes increasing for Albertans in 2025: Report

From the Canadian Taxpayers Federation

By Kris Sims

The Canadian Taxpayers Federation released its annual New Year’s Tax Changes report today to highlight major tax changes in 2025.

The key provincial tax change expected for Alberta is a reduction in the income tax rate.

“The Alberta government promised to reduce our lowest income tax bracket from 10 down to eight per cent and we expect the government to keep that promise in the new year,” said Kris Sims, CTF Alberta Director. “The United Conservatives said this provincial income tax cut would save families about $1,500 each and Alberta families need that kind of tax relief right now.

“Premier Danielle Smith promised to cut taxes and Albertans expect her to deliver.”

Albertans will see several federal tax hikes coming from Ottawa in 2025.

Payroll taxes: The federal government is raising the mandatory Canada Pension Plan and Employment Insurance contributions in 2025. These payroll tax increases will cost a worker up to an additional $403 next year.

Federal payroll taxes (CPP and EI tax) will cost a worker making $81,200 or more $5,507 in 2025. Their employer will also be forced to pay $5,938.

Carbon tax: The federal carbon tax is increasing to about 21 cents per litre of gasoline, 25 cents per litre of diesel and 18 cents per cubic metre of natural gas on April 1. The carbon tax will cost the average household between $133 and $477 in 2025-26, even after the rebates, according to the Parliamentary Budget Officer.

Alcohol taxes: Federal alcohol taxes will increase by two per cent on April 1. This alcohol tax hike will cost taxpayers $40.9 million in 2025-26, according to Beer Canada.

Following Budget 2024, the federal government also increased capital gains taxes and imposed a digital services tax and an online streaming tax.

Temporary Sales Tax Holiday: The federal government announced a two month sales tax holiday on certain items like pre-made groceries, children’s clothing, drinks and snacks. The holiday will last until Feb. 15, 2025, and could save taxpayers $2.7 billion.

“In 2025, the Trudeau government will yet again take more money out of Canadians’ pockets with payroll tax hikes and will make life more expensive by raising carbon taxes and alcohol taxes,” said Franco Terrazzano, CTF Federal Director. “Prime Minister Justin Trudeau should drop his plans to take more money out of Canadians’ pockets and deliver serious tax relief.”

You can find the CTF’s New Year’s Tax Changes report HERE.

Alberta

Fraser Institute: Time to fix health care in Alberta

From the Fraser Institute

By Bacchus Barua and Tegan Hill

Shortly after Danielle Smith was sworn in as premier, she warned Albertans that it would “be a bit bumpy for the next 90 days” on the road to health-care reform. Now, more than two years into her premiership, the province’s health-care system remains in shambles.

According to a new report, this year patients in Alberta faced a median wait of 38.4 weeks between seeing a general practitioner and receiving medically necessary treatment. That’s more than eight weeks longer than the Canadian average (30.0 weeks) and more than triple the 10.5 weeks Albertans waited in 1993 when the Fraser Institute first published nationwide estimates.

In fact, since Premier Smith took office in 2022, wait times have actually increased 15.3 per cent.

To be fair, Premier Smith has made good on her commitment to expand collaboration with the private sector for the delivery of some public surgeries, and focused spending in critical areas such as emergency services and increased staffing. She also divided Alberta Health Services, arguing it currently operates as a monopoly and monopolies don’t face the consequences when delivering poor service.

While the impact of these reforms remain largely unknown, one thing is clear: the province requires immediate and bold health-care reforms based on proven lessons from other countries (e.g. Australia and the Netherlands) and other provinces (e.g. Saskatchewan and Quebec).

These reforms include a rapid expansion of contracts with private clinics to deliver more publicly funded services. The premier should also consider a central referral system to connect patients to physicians with the shortest wait time in their area in public or private clinics (while patients retain the right to wait longer for the physician of their choice). This could be integrated into the province’s Connect Care system for electronic patient records.

Saskatchewan did just this in the early 2010s and moved from the longest wait times in Canada to the second shortest in just four years. (Since then, wait times have crept back up with little to no expansion in the contracts with private clinics, which was so successful in the past. This highlights a key lesson for Alberta—these reforms are only a first step.)

Premier Smith should also change the way hospitals are paid to encourage more care and a more patient-focused approach. Why?

Because Alberta still generally follows an outdated approach to hospital funding where hospitals receive a pre-set budget annually. As a result, patients are seen as “costs” that eat into the hospital budget, and hospitals are not financially incentivized to treat more patients or provide more rapid access to care (in fact, doing so drains the budget more rapidly). By contrast, more successful universal health-care countries around the world pay hospitals for the services they provide. In other words, by making treatment the source of hospital revenue, hospitals provide more care more rapidly to patients and improve the quality of services overall. Quebec is already moving in this direction, with other provinces also experimenting.

The promise of a “new day” for health care in Alberta is increasingly looking like a pipe dream, but there’s still time to meaningfully improve health care for Albertans. To finally provide relief for patients and their families, Premier Smith should increase private-sector collaboration, create a central referral system, and change the way hospitals are funded.

-

Housing2 days ago

Housing2 days agoTrudeau loses another cabinet member as Housing Minister Sean Fraser resigns

-

conflict2 days ago

conflict2 days agoTrump has started negotiations to end the war in Ukraine

-

Economy2 days ago

Economy2 days agoThe White Pill: Big Government Can Be Defeated (Just Ask the Soviet Union)

-

Business2 days ago

Business2 days agoFiscal update reveals extent of federal government mismanagement

-

Brownstone Institute1 day ago

Brownstone Institute1 day agoA Potpourri of the World’s Unexposed Scandals

-

National2 days ago

National2 days agoAs Trudeau’s government teeters, Pierre Poilievre pushes for immediate election call

-

conflict2 days ago

conflict2 days agoTrump’s election victory shows the American people want peace in Ukraine

-

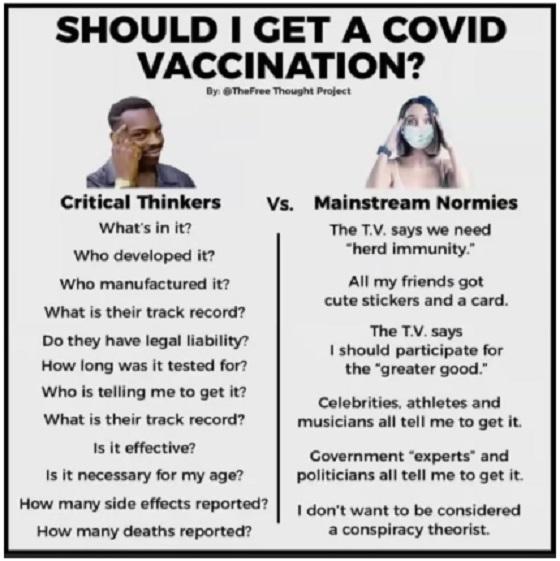

COVID-192 days ago

COVID-192 days agoBiden HHS extends immunity for COVID shot manufacturers through 2029