Alberta

Kings Indoor Track team wins gold, Queens earn silver at ACAC Championships

Brent Forster – Red Deer Polytechnic Athletics

Edmonton, AB – It was a great finale to the Alberta Colleges Athletic Conference (ACAC) Indoor Track season for the Red Deer Polytechnic Kings and Queens. On Sunday, the squads added seven more medals to their weekend haul at the championships.

The Red Deer Polytechnic Kings earned ACAC gold with the most team points. The Concordia University Thunder men picked up silver and the Lethbridge College Kodiaks solidified bronze.

“Our men had some challenges after a fast start yesterday. It was a battle out there, but the men won and did enough to bring home gold,” said Kari Elliott, Red Deer Polytechnic Indoor Track Head Coach. “It was the first in Red Deer Polytechnic’s history.”

The RDP Queens won silver, trailing only the Concordia University Thunder. The SAIT Trojans picked up bronze.

“We only had three ladies participating in individual events and they were all rookies,” said Elliott. “They picked up two golds in the relays this weekend.”

Third-year Lauren Pasiuk was the only member of the Queens with previous ACAC Indoor Track experience prior to this season.

Halle Reid (1:44.06) had another strong day, earning bronze in the women’s 600 m final.

In the women’s 1,500 m final, Justine Larson (5:32.54) solidified silver.

Kammy Park, Pasiuk, Larson and Reid (4:24.28) earned gold in the women’s 4 x 400 m relay.

In the men’s 1,500 m final, Dan Szucs (4:10.40) sealed a silver medal.

“Dan nailed his 1,500 metre and was key to the 4 x 400 metre,” said Elliott. “Wyatt [Grainger] and Jayden [Wildcat] achieved big personal bests in the 1,500 metre.”

Grainger achieved a time of 5:05.6 in the 1,500 m. Wildcat finished in 4:35.97.

Kevin Edmondson, Szucs, Daniel Humbke and Axsivier Lawrence captured bronze (3:43.86) in the men’s 4 x 400 m relay.

Larson, a Bachelor of Education Elementary student, was named ACAC Indoor Track Female Rookie of the Year.

Larson

Red Deer’s Ethan Duret was recognized as the ACAC Indoor Track Male Rookie of the Year.

Duret

“I am so proud of both teams,” said Elliott. “Looking at our young team, we are very optimistic about next season.”

Alberta

Alberta takes big step towards shorter wait times and higher quality health care

From the Fraser Institute

On Monday, the Smith government announced that beginning next year it will change the way it funds surgeries in Alberta. This is a big step towards unlocking the ability of Alberta’s health-care system to provide more, better and faster services for the same or possibly fewer dollars.

To understand the significance of this change, you must understand the consequences of the current (and outdated) approach.

Currently, the Alberta government pays a lump sum of money to hospitals each year. Consequently, hospitals perceive patients as a drain on their budgets. From the hospital’s perspective, there’s little financial incentive to serve more patients, operate more efficiently and provide superior quality services.

Consider what would happen if your local grocery store received a giant bag of money each year to feed people. The number of items would quickly decline to whatever was most convenient for the store to provide. (Have a favourite cereal? Too bad.) Store hours would become less convenient for customers, alongside a general decline in overall service. This type of grocery store, like an Alberta hospital, is actually financially better off (that is, it saves money) if you go elsewhere.

The Smith government plans to flip this entire system on its head, to the benefit of patients and taxpayers. Instead of handing out bags of money each year to providers, the new system—known as “activity-based funding”—will pay health-care providers for each patient they treat, based on the patient’s particular condition and important factors that may add complexity or cost to their care.

This turns patients from a drain on budgets into a source of additional revenue. The result, as has been demonstrated in other universal health-care systems worldwide, is more services delivered using existing health-care infrastructure, lower wait times, improved quality of care, improved access to medical technologies, and less waste.

In other words, Albertans will receive far better value from their health-care system, which is currently among the most expensive in the world. And relief can’t come soon enough—for example, last year in Alberta the median wait time for orthopedic surgeries including hip and knee replacements was 66.8 weeks.

The naysayers argue this approach will undermine the province’s universal system and hurt patients. But by allowing a spectrum of providers to compete for the delivery of quality care, Alberta will follow the lead of other more successful universal health-care systems in countries such as Australia, Germany, the Netherlands and Switzerland and create greater accountability for hospitals and other health-care providers. Taxpayers will get a much better picture of what they’re paying for and how much they pay.

Again, Alberta is not exploring an untested policy. Almost every other developed country with universal health care uses some form of “activity-based funding” for hospital and surgical care. And remember, we already spend more on health care than our counterparts in nearly all of these countries yet endure longer wait times and poorer access to services generally, in part because of how we pay for surgical care.

While the devil is always in the details, and while it’s still possible for the Alberta government to get this wrong, Monday’s announcement is a big step in the right direction. A funding model that puts patients first will get Albertans more of the high-quality health care they already pay for in a timelier fashion. And provide to other provinces an example of bold health-care reform.

Alberta

Alberta’s embrace of activity-based funding is great news for patients

From the Montreal Economic Institute

From the Montreal Economic Institute

Alberta’s move to fund acute care services through activity-based funding follows best practices internationally, points out an MEI researcher following an announcement made by Premier Danielle Smith earlier today.

“For too long, the way hospitals were funded in Alberta incentivized treating fewer patients, contributing to our long wait times,” explains Krystle Wittevrongel, director of research at the MEI. “International experience has shown that, with the proper funding models in place, health systems become more efficient to the benefit of patients.”

Currently, Alberta’s hospitals are financed under a system called “global budgeting.” This involves allocating a pre-set amount of funding to pay for a specific number of services based on previous years’ budgets.

Under the government’s newly proposed funding system, hospitals receive a fixed payment for each treatment delivered.

An Economic Note published by the MEI last year showed that Quebec’s gradual adoption of activity-based funding led to higher productivity and lower costs in the province’s health system.

Notably, the province observed that the per-procedure cost of MRIs fell by four per cent as the number of procedures performed increased by 22 per cent.

In the radiology and oncology sector, it observed productivity increases of 26 per cent while procedure costs decreased by seven per cent.

“Being able to perform more surgeries, at lower costs, and within shorter timelines is exactly what Alberta’s patients need, and Premier Smith understands that,” continued Mrs. Wittevrongel. “Today’s announcement is a good first step, and we look forward to seeing a successful roll-out once appropriate funding levels per procedure are set.”

The governments expects to roll-out this new funding model for select procedures starting in 2026.

* * *

The MEI is an independent public policy think tank with offices in Montreal, Ottawa, and Calgary. Through its publications, media appearances, and advisory services to policymakers, the MEI stimulates public policy debate and reforms based on sound economics and entrepreneurship.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoHarper Endorses Poilievre at Historic Edmonton Rally: “This Crisis Was Made in Canada”

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoMark Carney’s radical left-wing, globalist record proves he is Justin Trudeau 2.0

-

conflict2 days ago

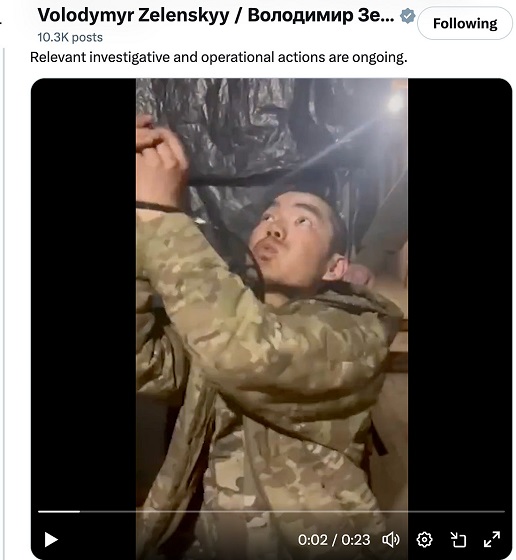

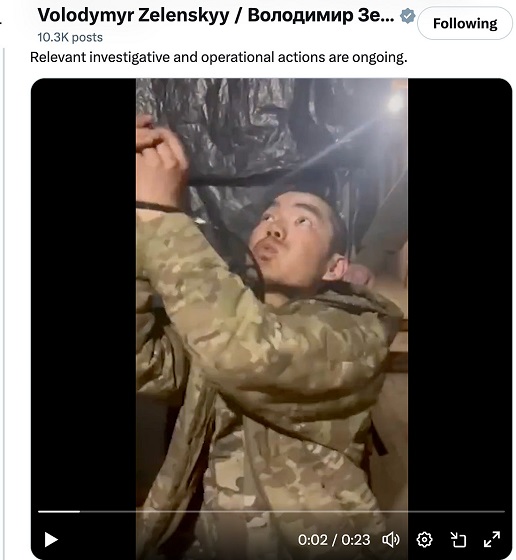

conflict2 days agoZelensky Alleges Chinese Nationals Fighting for Russia, Calls for Global Response

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoAn In-Depth Campaign Trail “Interview” With Pierre Poilievre

-

2025 Federal Election17 hours ago

2025 Federal Election17 hours agoConservative Party urges investigation into Carney plan to spend $1 billion on heat pumps

-

Business2 days ago

Business2 days agoTrump’s tariff plan replaces free trade with balanced trade. Globalists hate that.

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoScott Atlas: COVID lockdowns, censorship have left a ‘permanent black mark on America’

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoDon’t double-down on net zero again