Opinion

5 year study by NAIT shows angle of panel is more significant than snowfall in Northern Alberta

Study looks at impact of snow and angle of solar panels Old Man Winter takes a lot of flak in Alberta for everything from costly heating bills to frozen car batteries. But when it comes to the impact on solar panels, winter gets an unjustified bad rap.

A five-year study led by NAIT’s Alternative Energy Technology program found that snowfall on photovoltaic solar panels results in about a 3% energy loss. That’s significantly less than the 20% drain that industry had traditionally estimated despite a lack of data.

Tim Matthews, a technologist and one of the leads on the study, says the results will improve modelling used to estimate solar energy production that determines return on investment. Ultimately, that means a win for consumers.

NAIT launched the reference array snow study in 2012 with the City of Edmonton and Solar Energy Society of

Alberta. A system of 12 solar modules was installed atop the Shaw Theatre on Main Campus to not only measure the impact of snow on the system, but also how the tilt of each module affects energy production.

“The rule of thumb throughout industry was to design a system as if it had no snow and then wipe 20% of energy production off the slate – we’re going to lose 20% because we’re in Canada,” says Matthews. “Everybody was terrified of underestimating the impact of snow and latitude [on energy production].”

They found that the angle of the solar panels has a far greater impact on energy production than snowfall. Solar modules were fixed at six different angles – 14, 18, 27, 45, 53 and 90 degrees – which represent roof pitches commonly found on commercial buildings and homes. Six modules were cleared of snow every day, while the remaining six served as a control.

The least efficient was the module set at 90 degrees, like a wall-mount system, which saw a 24% loss in performance. The

module tilted to 53 degrees was most efficient, which confirmed an industry standard that solar systems are optimized when tilted to the equivalent of a city’s latitude.

The ideal angle for maximum production with snow accumulation was 45 degrees.

Matthews cautions that even five years worth of data is a small window when dealing with fluctuating variables such as

weather. But for a homeowner or business who already has historic data on their energy consumption, the tilt and snow impact clear up what had been a cloudy picture in predicting the cost-benefit of solar.

“Having this information raises the level of precision when it comes to engineering, design and production modelling,” says

Matthews. “A company that’s doing solar installation and design can go to a client and say, ‘This is precise. You can take this to the bank.’”

Crunching five years of data The work of crunching through all the data fell to students (and now grads of the class of ’18) Christian Brown and Jackson Belley as the basis of their final course project, or capstone.

That’s no mean feat considering energy performance data was collected from all 12 solar modules every five minutes every

day for five years – enough to fill 6,000 spreadsheet files.

“It was an insane amount of data,” says Brown. “That was not quite half, maybe the first third of the project. Months of work. It was a lot of learning.”

After five years of getting up at all hours to clear snow from the reference array – including Christmas – Matthews is glad

to be rid of that daily chore. For anyone who operates a solar system, he cautions that snow should only be cleared if it’s

safe to do so, such as on a flat commercial roof.

“Should you clean the ones on your [pitched] roof? Heck no,” he says. Nor does he recommend asking a contractor to

remove it. It’s just not worth it for the minimal gain in power efficiency from a snow-free solar system.

“Our recommendation is that it makes no sense. One hour of time from a professional or an apprentice is just not worth

it.”

Data was gradually exported by day, month, season and year, making it more digestible and user-friendly for industry,

government and institutions, but also the schools and not-for-profits, who are interested in the information.

The study’s interim findings are available online, while the students’ final report with datasets will be published on the

Alternative Energy Technology program page this fall. It’s expected to be a hot commodity. (Anyone can request the data now).

“The amount of requests that we get [for the data], it’s obvious people are interested and they want to know how does snow

affect solar modules,” says Belley.

Brown adds it’s a pretty cool feeling to work on a class assignment that has a major real-world impact. “The idea of solar won’t be as much of a gamble any more.”

Plans are also in the works to submit the findings for peer review and publication in a scientific journal.

After reading this report and remembering that both the Province of Alberta and the City of Red Deer are looking into a program that would pay for the program and be billed via your property taxes over 10 years.

The province and the city were very much forward thinking, I would offer and if snow loses only 3 % of power it does make more sense. Right?

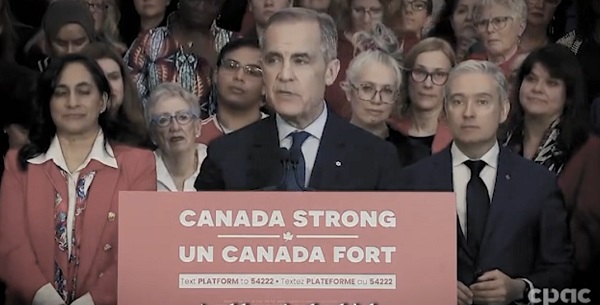

2025 Federal Election

POLL: Canadians want spending cuts

By Gage Haubrich

By Gage Haubrich

The Canadian Taxpayers Federation released Leger polling showing Canadians want the federal government to cut spending and shrink the size and cost of the bureaucracy.

“The poll shows most Canadians want the federal government to cut spending,” said Gage Haubrich, CTF Prairie Director. “Canadians know they pay too much tax because the government wastes too much money.”

Between 2019 and 2024, federal government spending increased 26 per cent even after accounting for inflation. Leger asked Canadians what they think should happen to federal government spending in the next five years. Results of the poll show:

- 43 per cent say reduce spending

- 20 per cent say increase spending

- 16 per cent say maintain spending

- 20 per cent don’t know

The federal government added 108,000 bureaucrats and increased the cost of the bureaucracy 73 per cent since 2016. Leger asked Canadians what they think should happen to the size and cost of the federal bureaucracy. Results of the poll show:

- 53 per cent say reduce

- 24 per cent say maintain

- 4 per cent say increase

- 19 per cent don’t know

Liberal Leader Mark Carney promised to “balance the operating budget in three years.” Leger asked Canadians if they believed Carney’s promise to balance the budget. Results of the poll show:

- 58 per cent are skeptical

- 32 per cent are confident

- 10 per cent don’t know

“Any politician that wants to fix the budget and cut taxes will need to shrink the size and cost of Ottawa’s bloated bureaucracy,” Haubrich said. “The polls show Canadians want to put the federal government on a diet and they won’t trust promises about balancing the budget unless politicians present credible plans.”

2025 Federal Election

How Canada’s Mainstream Media Lost the Public Trust

Breaking: CBC News admits that host Rosemary Barton was wrong on April 16 when she said “remains of indigenous children” have been discovered.

Call it the Panic Election. From The Handmaid’s Tale to Quebec alienation to plastic straws, the dynamic is citizens being stampeded in a brief six weeks by Big Brother. (There’s no Big Sister. That would mess with the narrative.) Prompting Covid Part Deux from the Laurentian media scolds.

Nowhere is this panic more keen than among aging Boomers who’ve pronounced themselves willing to ignore a decade of Justin Trudeau’s clumsy, unethical and sometimes criminal behaviour in the wake of Big Bad Trump. Even the threat of losing the country’s AAA credit rating can’t sway them from full-throated panic about being the 51st state.

The 51st state gambit is the window dressing. The real Trump panic is over him exposing the inadequacies of a Canadian society penetrated by China, dominated by globalist fanatics and more indebted every day. Specifically, Trump labelled Canadians defence dead-beats and entitled snobs who’d be crazy not to join the U.S. The insulting Trump framing has been a lifeline to those most recently in office— Liberals— to point at the Big Bad Wolf outside the door rather than the Frozen Venezuela inside its walls.

Integral to this panic is the role of Canada’s legacy media, a self-serving caste saved from bankruptcy (for now) by generous wads of public money. The 416/613 bubble ponies operate as if it were still 1985, not 2025. They’ve managed to preserve their status while society changed around them. For instance, CBC’s flagship At Issue panel features three people from Toronto and a fourth from Montreal.

It has worked perfectly in Boomer Canada. Until this past week, when the media guardians finally lost the plot. The combination of TV panel hubris and the incompetence of the Elections Commission exposed an industry more interesting in protecting its own turf than protecting the truth.

The meltdown was the notion that conservative social media— with its intrusive reporters and tabloid tactics— had no place in their sandbox. This hissy fit came after Wednesday’s French debate. Members of Rebel News, True North and other outfits dominated the party leaders’ scrums with obtrusive questions about Mark Carney’s opinions on same-sex sports and what constitutes a woman— questions the French moderator had neglected to ask.

For legacy reporters and hosts who take it as given that they be allowed the front pew this was an affront to their status. As purveyors of the one true political religion the talking heads on CBC, CTV and Global began speaking of “so-called journalists” and “far-right” intruders elbowing into their territory. Their resentment was all-consuming.

This resentment spilled into Debate Night Two when a shouting match ensued in the press room. A CBC source claimed (incorrectly) that Rebel Media leader Ezra Levant had been barred from the press room. A writer from the Hill Times screamed at members of their raucous rivals. The carefully chose panelists suggested that these outfits were funded by dark right-wing sources.

Before the debate had ended Elections Commission organizers— reportedly goaded by the Liberals— called off the post-debate scrum citing “safety” issues that seemingly included a Rebel reporter conducting a hostile walking interview with a furious Liberal official. This unleashed another torrent of Media Party vitriol about its position as the keepers of Canadian journalism.

In a show of irony, these complaints about right-wing misinformation came from people whose livelihood is dependent on Liberal slush funds or whose organizations have accepted government funds to stave off bankruptcy or whose union is an active shill for non-Conservative parties. The conflicts are never mentioned in the unctuous festival of privilege.

What makes this rearguard action against new media risible was the 2024 U.S. election where Donald Trump acknowledged the new day and rode the support of non-traditional media back to the presidency. His shunning of the legacy networks and hallowed print brands heralded a new reality in American elections. Poilievre has struggled to find this community in Canada, but for those with eyes it remains the future of disseminating political thought.

A perfect example of alternative media scooping the tenured mob on Parliament Hill has been the sterling work on China by Sam Cooper, a former Global employee who has independently demonstrated the ties between Chinese criminal gangs and the Canadian political structure going back to the 1980s. Working with others outside the grid he’s shown the scandal of a Liberal candidate urging Chinese Canadian voters to reap a bounty for turning his Conservative opponent to the Chinese Communist Party. A disgrace that Carney has forgiven.

Predictably Cooper’s work and the independent story by two retired RCMP investigators who implicated nine Liberal cabinet members in compliance with the Chinese communists has gotten the ‘tish-tish” from the Laurentian elites. Like the Democrats who buried the Hunter Biden laptop story to save his father in the dying days of the 2020 U.S. election the poodle media hope to delay the truths about China long enough to get the compliant Carney over the finish line.

For contrast to how it was— and could be— one only had to witness the moderator performance of journalist Steve Paikin of TVO. Largely unknown outside Ontario, Paikin overcame the skepticism of Westerners by playing it straight down the middle. Such was his honest-broker performance that Poilievre was heard telling him after the debate that he had no idea how Paikin might vote. (Ed. note: Paikin is a former colleague and longtime friend.) In other words, it’s still possible.

It’s a cliché that this election is a hinge point for Canada. Will it face itself in the mirror or indulge in more denialism about its true self? No wonder unaffiliated journalists joke that their stories today will be the lead on mainstream media in three months. Carney has promised to continue bribing the mainstream media, but their day is done. It’s simply a matter of fixing a date for the next panic.

Bruce Dowbiggin @dowbboy is the editor of Not The Public Broadcaster A two-time winner of the Gemini Award as Canada’s top television sports broadcaster. His new book Deal With It: The Trades That Stunned The NHL And Changed Hockey is now available on Amazon. Inexact Science: The Six Most Compelling Draft Years In NHL History, his previous book with his son Evan, was voted the seventh-best professional hockey book of all time by bookauthority.org. You can see all his books at brucedowbigginbooks.ca.

-

Alberta2 days ago

Alberta2 days agoProvince to expand services provided by Alberta Sheriffs: New policing option for municipalities

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCSIS Warned Beijing Would Brand Conservatives as Trumpian. Now Carney’s Campaign Is Doing It.

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoIs HNIC Ready For The Winnipeg Jets To Be Canada’s Heroes?

-

Alberta2 days ago

Alberta2 days agoMade in Alberta! Province makes it easier to support local products with Buy Local program

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoNo Matter The Winner – My Canada Is Gone

-

Health2 days ago

Health2 days agoHorrific and Deadly Effects of Antidepressants

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCampaign 2025 : The Liberal Costed Platform – Taxpayer Funded Fiction

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoA Perfect Storm of Corruption, Foreign Interference, and National Security Failures