Alberta

3 more Calgarians die from Coronavirus – Alberta Update April 8

From the Province of Alberta

Update 26: COVID-19 pandemic in Alberta (April 8 at 5 p.m.)

There are now 518 confirmed recovered cases of COVID-19.

Fifty new cases have been reported, bringing the total number of cases in Alberta to 1,423.

Three more Albertans, including a resident at the McKenzie Towne Continuing Care Centre, have died since the last report, bringing the total deaths in the province to 29.

Latest updates

- A total of 1,005 cases are laboratory confirmed and 418 are probable cases (symptomatic close contacts of laboratory confirmed cases). Laboratory positivity rates remain consistent at two per cent.

- Cases have been identified in all zones across the province:

- 860 cases in the Calgary zone

- 368 cases in the Edmonton zone

- 95 cases in the North zone

- 72 cases in the Central zone

- 26 cases in the South zone

- Two cases in zones yet to be confirmed

- Of these cases, there are currently 44 people in hospital, 16 of whom have been admitted to intensive care units (ICU).

- Of the 1,423 total cases, 206 are suspected of being community acquired.

- There are now a total of 518 confirmed recovered cases.

- The three new deaths are from the Calgary zone, bringing the total in this zone to 20. Four people have died in the Edmonton zone, four in the North zone, and one in the Central zone.

- Stronger outbreak measures have been put in place at continuing care facilities. To date, 145 cases have been confirmed at these facilities.

- There have been 66,783 people tested for COVID-19 and a total of 68,726 tests performed by the lab. There were 1,645 tests completed in the last 24 hours.

- Aggregate data, showing cases by age range and zone, as well as by local geographic areas, is available online at alberta.ca/covid19statistics.

- All Albertans need to work together to help prevent the spread and overcome COVID-19.

- Restrictions remain in place for all gatherings and close-contact businesses, dine-in restaurants and non-essential retail services. A full list of restrictions is available online.

- Tighter restrictions have been placed on visitors to continuing care centres, group homes and other facilities. No visitors will be allowed unless a resident is dying or the visitor is essential for delivering care that cannot be delivered by staff.

- Restrictions remain in place for all gatherings and close-contact businesses, dine-in restaurants and non-essential retail services. A full list of restrictions is available online.

- A new guidance document is posted for symptomatic and asymptomatic health-care workers and those in public health enforcement. The document outlines next steps for isolation or return to work.

- As Albertans look forward to the holiday weekend, they are being reminded to:

- avoid gatherings outside of their immediate household

- find ways to connect while being physically separated

- worship in a way that does not put people at risk, including participating in virtual or live-streamed religious celebrations

More guidelines for faith-based organizations can be found online.

Modelling the extent of COVID-19 in Alberta

The province released two different scenarios or forecasts estimating the trajectory of COVID-19 in Alberta and the impacts on the health system. Preparing for multiple scenarios – including the probable trajectory and an elevated trajectory – help ensure the right resources and supports are in place to help Albertans. This includes sufficient hospital and intensive care unit beds, ventilators and protective personal equipment for Albertans and the health-care workers caring for them. Full details of the modelling are available here.

Regulatory reporting deferrals

The Government of Alberta is immediately deferring specific legislated reporting requirements for energy companies under the Coal Conservation Act, the Oil and Gas Conservation Act and the Oil Sands Conservation Act.

These deferrals will not affect any monitoring requirements that ensure Alberta’s public safety and environmental protection, or any reporting required for royalty calculation and collection.

The order will expire on August 14, or 60 days after the date on which the public health emergency ends, whichever is earlier.

Quick facts

- The most important measures that Albertans can take to prevent respiratory illnesses, including COVID-19, is to practise good hygiene.

- This includes cleaning your hands regularly for at least 20 seconds, avoiding touching your face, coughing or sneezing into your elbow or sleeve, disposing of tissues appropriately.

- Anyone who has health concerns or is experiencing symptoms of COVID-19 should complete an online COVID-19 self-assessment.

- For recommendations on protecting yourself and your community, visit alberta.ca/COVID19.

Alberta

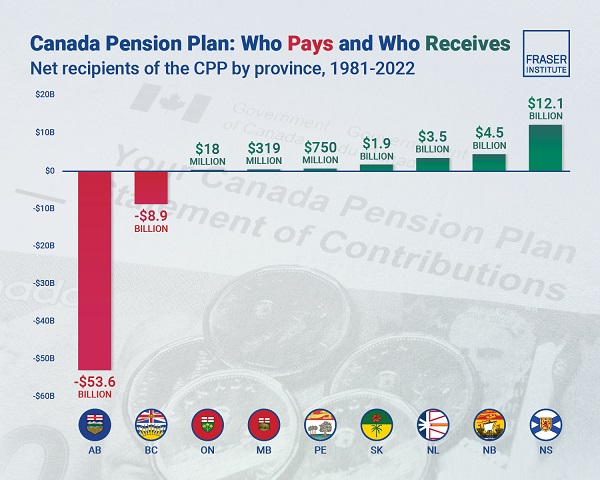

Albertans have contributed $53.6 billion to the retirement of Canadians in other provinces

From the Fraser Institute

By Tegan Hill and Nathaniel Li

Albertans contributed $53.6 billion more to CPP then retirees in Alberta received from it from 1981 to 2022

Albertans’ net contribution to the Canada Pension Plan —meaning the amount Albertans paid into the program over and above what retirees in Alberta

received in CPP payments—was more than six times as much as any other province at $53.6 billion from 1981 to 2022, finds a new report published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Albertan workers have been helping to fund the retirement of Canadians from coast to coast for decades, and Canadians ought to know that without Alberta, the Canada Pension Plan would look much different,” said Tegan Hill, director of Alberta policy at the Fraser Institute and co-author of Understanding Alberta’s Role in National Programs, Including the Canada Pension Plan.

From 1981 to 2022, Alberta workers contributed 14.4 per cent (on average) of the total CPP premiums paid—Canada’s compulsory, government- operated retirement pension plan—while retirees in the province received only 10.0 per cent of the payments. Alberta’s net contribution over that period was $53.6 billion.

Crucially, only residents in two provinces—Alberta and British Columbia—paid more into the CPP than retirees in those provinces received in benefits, and Alberta’s contribution was six times greater than BC’s.

The reason Albertans have paid such an outsized contribution to federal and national programs, including the CPP, in recent years is because of the province’s relatively high rates of employment, higher average incomes, and younger population.

As such, if Alberta withdrew from the CPP, Alberta workers could expect to receive the same retirement benefits but at a lower cost (i.e. lower payroll tax) than other Canadians, while the payroll tax would likely have to increase for the rest of the country (excluding Quebec) to maintain the same benefits.

“Given current demographic projections, immigration patterns, and Alberta’s long history of leading the provinces in economic growth, Albertan workers will likely continue to pay more into it than Albertan retirees get back from it,” Hill said.

Understanding Alberta’s Role in National Programs, Including the Canada Pension Plan

- Understanding Alberta’s role in national income transfers and other important programs is crucial to informing the broader debate around Alberta’s possible withdrawal from the Canada Pension Plan (CPP).

- Due to Alberta’s relatively high rates of employment, higher average incomes, and younger population, Albertans contribute significantly more to federal revenues than they receive back in federal spending.

- From 1981 to 2022, Alberta workers contributed 14.4 percent (on average) of the total CPP premiums paid while retirees in the province received only 10.0 percent of the payments. Albertans net contribution was $53.6 billion over the period—approximately six times greater than British Columbia’s net contribution (the only other net contributor).

- Given current demographic projections, immigration patterns, and Alberta’s long history of leading the provinces in economic growth and income levels, Alberta’s central role in funding national programs is unlikely to change in the foreseeable future.

- Due to Albertans’ disproportionate net contribution to the CPP, the current base CPP contribution rate would likely have to increase to remain sustainable if Alberta withdrew from the plan. Similarly, Alberta’s stand-alone rate would be lower than the current CPP rate.

Tegan Hill

Director, Alberta Policy, Fraser Institute

Alberta

Alberta Institute urging Premier Smith to follow Saskatchewan and drop Industrial Carbon Tax

From the Alberta Institute

Axe Alberta’s Industrial Carbon Tax

Aside from tariffs, carbon taxes have been the key topic of the election campaign so far, with Mark Carney announcing that the Liberals would copy the Conservatives’ long-standing policy to axe the tax – but with a big caveat.

You see, it’s misleading to talk about the carbon tax as if it were a single policy.

In fact, that’s what the Liberals would like you to think because it helps them hide all the other carbon taxes they’ve forced on Canadians and on the Provinces.

Broadly speaking, there are actually four types of carbon taxes in place in Canada:

- A federal consumer carbon tax

- A federal industrial carbon tax

- Various provincial consumer carbon taxes

- Various provincial industrial carbon taxes

Alberta was actually the first jurisdiction anywhere in North America to introduce a carbon tax in 2007, when Premier Ed Stelmach introduced a provincial industrial carbon tax.

Then, as we all know, the Alberta NDP introduced a provincial consumer carbon tax in 2017.

The provincial consumer carbon tax was short-lived, as the UCP repealed it in 2019.

But, unfortunately, the UCP failed to repeal the provincial industrial carbon tax at the same time.

Worse, by then, the federal Liberals had introduced a federal consumer carbon tax and a federal industrial carbon tax as well!

Flash forward to 2025, and the political calculus has changed dramatically.

Mark Carney might only be promising to get rid of the federal consumer carbon tax, but Pierre Poilievre is promising to get rid of both the federal consumer carbon tax and the federal industrial carbon tax.

This is a clear opportunity, and yesterday, Scott Moe jumped on it.

He announced that Saskatchewan will also be repealing its provincial industrial carbon tax.

Saskatchewan never had a provincial consumer carbon tax, which means that, within just a few weeks, people in Saskatchewan could be paying ZERO carbon tax of ANY kind.

Alberta needs to follow Saskatchewan’s lead.

The Alberta government should immediately repeal Alberta’s provincial industrial carbon tax.

There’s no excuse for our provincial government to continue burdening our industries with unnecessary costs that hurt competitiveness and deter investment.

These taxes make it harder for businesses to thrive, grow, and create jobs, especially when other provinces are taking action to eliminate similar policies.

Premier Danielle Smith must act now and eliminate the provincial industrial carbon tax in Alberta.

If you agree, please sign our petition calling on the Alberta government to Axe Alberta’s Industrial Carbon Tax today:

After you’ve signed, please send the petition to your friends, family, and wider network, so that every Albertan can have their voice heard!

– The Alberta Institute Team

-

Justice2 days ago

Justice2 days agoDemocracy watchdog calls for impartial prosecution of Justin Trudeau

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPoilievre refuses to bash Trump via trick question, says it’s possible to work with him and be ‘firm’

-

Business2 days ago

Business2 days agoPublicity Kills DEI: A Free Speech Solution to Woke Companies

-

Dr. Robert Malone2 days ago

Dr. Robert Malone2 days agoWHO and G20 Exaggerate the Risk and Economic Impact of Outbreaks

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoVoters should remember Canada has other problems beyond Trump’s tariffs

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPoilievre to let working seniors keep more of their money

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCanadian officials warn Communist China ‘highly likely’ to interfere in 2025 election

-

COVID-191 day ago

COVID-191 day ago17-year-old died after taking COVID shot, but Ontario judge denies his family’s liability claim