Automotive

U.S. politics looms large over Trudeau/Ford EV gamble

From the Fraser Institute

Political developments in the U.S. over the past few years have substantially increased the risk of any investment that relies on unrestricted access to the U.S. market

Last week, the Trudeau government and the Ford government announced a new multi-billion dollar taxpayer-funded subsidy for Honda to expand its Alliston, Ontario plant to manufacture electric vehicles (EV) and host a large EV battery plant. Eventually, the direct and indirect subsidies could total $10 billion from the two governments.

The Honda announcement follows earlier deals with Northvolt, Stellantis and Volkswagen to build and operate EV battery and auto assembly plants in Ontario. According to the Parliamentary Budget Officer, these three deals may total $50.7 billion after accounting for the cost of government borrowing to finance the subsidies and foregone corporate tax revenue from tax abatements tied to production.

Clearly, if future taxpayers across the country (not just in Ontario) are to avoid a huge additional tax burden or suffer reductions in government services, a lot needs to go right for Canada’s EV industry.

In particular, there must emerge sufficient market demand for EVs so these “investments” in the EV auto sector will be fully paid for by future tax revenues from corporate and personal income taxes levied on companies and workers in the EV sector. During their joint announcement of the Honda deal, both Prime Minister Trudeau and Premier Ford ignored this elephant in the room while claiming that the Honda deal will mean 240,000 vehicles a year manufactured at the site and 4,200 jobs preserved, while adding another 1,000 jobs.

By way of perspective, in 2023 around 185,000 EV vehicles were sold in Canada—about 11 per cent of all new cars sold in Canada that year. This is considerably less than the target capacity of the Honda complex and the total expected production capacity of Canada’s EV sector once all the various announced subsidized production facilities are in operation. In contrast, 1.2 million EVs were sold in the United States.

The demand for EVs in Canada will likely grow over time, especially given the increased incentive the federal government now has to ensure, through legislation or regulation, that Canadians retire their gas-powered vehicles and replace them with EVs. However, the long-run financial health of Canada’s EV sector requires continued access to the much larger U.S. market. Indeed, Honda’s CEO said his company chose Canada as the site for their first EV assembly plant in part because of Canada’s access to the U.S. market.

But political developments in the U.S. over the past few years have substantially increased the risk of any investment that relies on unrestricted access to the U.S. market. The trade protectionist bent of Donald Trump, the Republican nominee in the upcoming presidential election, is well known and he reportedly plans to impose a broad 10 per cent tariff on all manufactured imports to the U.S. if elected.

While the Canada-U.S.-Mexico Free Trade Agreement ostensibly gives Canadian-based EV producers tariff-free access to the U.S. market, Trump could terminate the treaty or at least insist on major changes in specific Canadian trade policies that he criticized during his first term, including supply management programs for dairy products. The trade agreement is up for trilateral review in 2025, which would allow a new Trump administration to demand political concessions such as increased Canadian spending on defence, in addition to trade concessions.

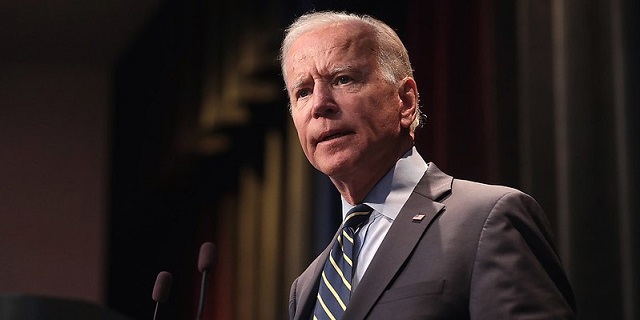

Nor would the re-election of President Joe Biden immunize Canada from protectionist risks. Biden has been a full-throated supporter of unionized U.S. auto workers and has staked his administration’s legacy on the successful electrification of the U.S. transportation sector through domestic production. Given his government’s financial commitment to growing a domestic EV sector, Biden might well impose trade restrictions on Canada if Canadian exports start to displace domestic production in the U.S.

In short, Canadian politicians, most notably Justin Trudeau and Doug Ford, have staked the future of Canada’s heavily subsidized domestic EV sector on the vagaries of the U.S. political process, which is increasingly embracing “America First” industrial policies. This may turn out to be a very costly gamble for Canadian taxpayers.

Author:

Automotive

Electric vehicle mandates mean misery all around

From the Fraser Institute

By Matthew Lau

The latest news of slowing demand for electric vehicles highlight the profound hazards of the federal government’s Soviet-style mandate that 100 per cent of new light-duty vehicles sold must be electric or plug-in hybrid by 2035 (with interim targets of 20 per cent by 2026 and 60 per cent by 2030, with steep penalties for dealers missing these targets).

The targets were wild to begin with—as Manhattan Institute senior fellow Mark P. Mills observed, bans on conventional vehicles and mandated switches to electric mean, in jurisdictions such as Canada, “consumers will need to adopt EVs at a scale and velocity 10 times greater and faster than the introduction of any new model of car in history.”

Indeed, when the Trudeau government announced its mandate last December, conventional vehicles accounted for 87 per cent of the market, and today the mandated switch to electric looks even more at odds with actual consumer preferences. According to reports, Tesla will cut its global workforce by more than 10 per cent (or more than 14,000 employees) due to slowing electric vehicle demand.

In Canada, a Financial Post headline reads, “‘Tall order to ask the average Canadian’: EVs are twice as hard to sell today.” Not only has Tesla’s quarterly sales declined, Ford Motor Co. announced in April it will delay the start of electric vehicle production at its Oakville plant by two years, from 2025 to 2027.

According to research from global data and analytics firm J.D. Power, it now takes 55 days to sell an electric vehicle in Canada, up from 22 days in the first quarter of 2023 and longer than the 51 days it takes a gasoline-powered car to sell. This is the result, some analysts suggest, of a lack of desirable models and high consumer prices—and despite federal subsidies to car buyers of up to $5,000 per electric vehicle and additional government subsidies in six provinces, as high as $7,000 in Quebec.

Similarly in the United States, the Wall Street Journal reports that on average, electric vehicles and plug-in hybrids sit in dealer lots longer than gasoline-powered cars and hybrids. Again, that’s despite heavy government pressure to switch to electric—the Biden administration mandated two-thirds of new vehicles sold must be electric by 2032.

In both Canada and the U.S., politicians banning consumers from buying vehicles they want and instead forcing them to buy the types of vehicles that run contrary to their preferences, call to mind famed philosopher Adam Smith’s “man of system,” described in his 1759 book, The Theory of Moral Sentiments.

The man of system, Smith explained, “is apt to be very wise in his own conceit” and “seems to imagine that he can arrange the different members of a great society with as much ease as the hand arranges the different pieces upon a chess–board.” But people are not chess pieces to be moved around by a hand from above; they have their own agency and if pushed by the “man of system” in a direction opposite to where they want to go, the result will be misery and “society must be at all times in the highest degree of disorder.”

That nicely sums up the current government effort to mandate electric vehicles contrary to consumer preferences. The vehicle market is in a state of disorder as the government tries to force people to buy the types of cars many of them do not want, and the outcomes are miserable all around.

Author:

Automotive

Biden’s Climate Agenda Is Running Headfirst Into A Wall Of His Own Making

From the Daily Caller News Foundation

From the Daily Caller News Foundation

By WILL KESSLER

President Joe Biden’s administration unveiled tariffs this week aimed at boosting domestic production of green energy technology, but the move could end up hamstringing his larger climate goals.

The tariffs announced on Tuesday quadruple levies for Chinese electric vehicles (EVs) to 100% and raise rates for certain Chinese green energy and EV components like minerals and batteries. Biden has made the transition to green energy and EVs a key part of his climate agenda, but hiking tariffs on those products to help U.S. manufacturing could jack up prices on the already costly products, slowing adoption by struggling Americans, according to experts who spoke to the DCNF.

The risks posed by hiking levies on green technology expose the inherent tension between Biden’s climate agenda and his efforts to protect American industry, which often struggles to compete with cheap foreign labor. Items on his climate agenda typically raise costs, and requiring companies to comply could make them uncompetitive on the world stage.

“These tariffs are a classic example of the Biden administration’s left hand not knowing what the right hand is doing,” E.J. Antoni, a research fellow at the Heritage Foundation’s Grover M. Hermann Center for the Federal Budget, told the DCNF. “The inability to import Chinese-made EVs due to prohibitively high costs will necessitate importing raw materials and parts for EVs from China. Since automakers can’t afford to build and assemble the vehicles here, prices will have to rise. In other words, American consumers will pay the cost of this tariff, not the Chinese.”

The White House, in its fact sheet, pointed to China artificially lowering its prices and dumping goods on the global market as the justification for the new tariffs in an effort to help protect American businesses. China has pumped huge subsidies into its own EV industry and supply lines over the past few years, spawning a European Union investigation into vehicles from the country.

“Tariffs on Chinese EVs won’t just make Chinese EVs more expensive, they will also make American EVs more expensive,” Ryan Young, senior economist at the Competitive Enterprise Institute, told the DCNF. “This is because domestic producers can now raise their prices without fear of being undercut by competitors. Good for them but bad for consumers — and for the Biden administration’s policy goal of increased EV adoption.”

Several American manufacturers are already struggling to sell EVs at a profit, with Ford losing $4.7 billion on its electric line in 2023 while selling over 72,000 of the vehicles. To ease price concerns and increase EV adoption, the Biden administration created an EV tax credit of $7,500 per vehicle, depending on where its parts are made.

The market share of EVs out of all vehicles fell in the first quarter of 2024 from 7.6% to 7.1% as consumers opted to buy cheaper traditional vehicles instead. Growth in EV sales increased by just 2.7% in the quarter, far slower than the 47% growth that the industry saw in all of 2023.

The Biden administration has also sought to use regulations to push automakers toward electrifying their offerings as consumers refuse to voluntarily adopt EVs, finalizing rules in March that effectively require around 67% of all light-duty vehicles sold after 2032 to be electric or hybrids.

“By raising the price — and thereby stunting the deployment — of EVs, the tariffs undermine the Biden administration’s stated goals of reducing carbon emissions (as many U.S. environmentalists and EV fans have recently lamented),” Clark Packard, research fellow in the Herbert A. Stiefel Center for Trade Policy Studies at the Cato Institute, wrote following the announcement. “The EV tariffs (and also-announced solar tariffs) would continue the administration’s habit of choosing politics and protectionism over their environmental agenda.”

Despite the subsidies, the 25% tariff that is currently in place for Chinese EVs already prices the product out of the U.S. market, resulting in no Chinese-branded EVs being sold in the country, according to Barron’s. Only a handful of the more than 100 EV models being sold in China appeal to American consumers, and none of them can compete under current levies.

“Something like this happened just a few years ago when former president Donald Trump enacted 25% steel tariffs in 2018,” Young told the DCNF. “Domestic steel producers raised their prices by almost exactly the amount of the tariff, and America soon had the world’s highest steel prices. As a result, car prices went up by about $200 to $300 on average. Larger trucks with more steel content increased even more. Now Biden is going to do the same thing to EVs.”

I won’t allow American towns and workers to be hurt by China’s unfair trade practices that flood our markets with cheap products.

That’s what these new tariffs are all about. pic.twitter.com/GGApGqtg7O

— President Biden (@POTUS) May 15, 2024

In the year following the increase in steel tariffs under the Trump administration, U.S. Steel’s operating profit rose 38%, prices were hiked 5 to 10% and revenue was up 15% due to reduced competition, according to CNN.

Despite the massive tariff hike on EVs, Biden only raised the tariff rate on Chinese lithium-ion EV batteries and battery parts to 25%, according to the White House. The tariff rate on certain essential minerals, like natural graphite, was also hiked to just 25%.

“Despite rapid and recent progress in U.S. onshoring, China currently controls over 80% of certain segments of the EV battery supply chain, particularly upstream nodes such as critical minerals mining, processing, and refining,” the White House wrote in its fact sheet. “Concentration of critical minerals mining and refining capacity in China leaves our supply chains vulnerable and our national security and clean energy goals at risk.”

China has broad control over the majority of minerals necessary to construct EVs, possessing nearly 90% of the world’s mineral refining capacity. Sources of the required minerals often also have serious human rights concerns, such as the world’s supply of cobalt, which has widespread ties to child labor.

Biden attacked former President Donald Trump during the 2020 election for the broad tariffs that he put on Chinese goods, noting that “any freshman econ student” could point out that the costs of the tariffs would be passed on to American consumers.

EV makers have increasingly struggled over the past year to maintain profits amid stalling demand, with the largest American EV manufacturer, Tesla, reporting a 10% drop in year-over-year revenue in the first quarter of 2024. Tesla is one of several EV makers that have announced layoffs in recent months.

“Fortunately, the EV market is still small in the U.S. and Chinese EVs are an even smaller slice of that small pie,” Antoni told the DCNF. “Even if the EV market in the U.S. were large, these tariffs would not help the domestic EV industry. While consumer demand for EVs would shift to domestic models, an increase in domestic production would rely on very expensive inputs from China, cutting into profits.”

The White House did not respond to a request to comment from the DCNF.

-

Brownstone Institute7 hours ago

Brownstone Institute7 hours agoMedical Elites’ Disgrace Over Ivermectin

-

National5 hours ago

National5 hours agoDespite claims of 215 ‘unmarked graves,’ no bodies have been found at Canadian residential school

-

COVID-1939 mins ago

COVID-1939 mins agoThe New York Times Admits Injuries from COVID-19 Shots

-

Automotive12 hours ago

Automotive12 hours agoElectric vehicle mandates mean misery all around

-

Energy4 hours ago

Energy4 hours agoFederal government continues to reject golden opportunities to export LNG

-

Opinion11 hours ago

Opinion11 hours agoThe American Experiment Has Gone Down In Flames

-

Energy2 days ago

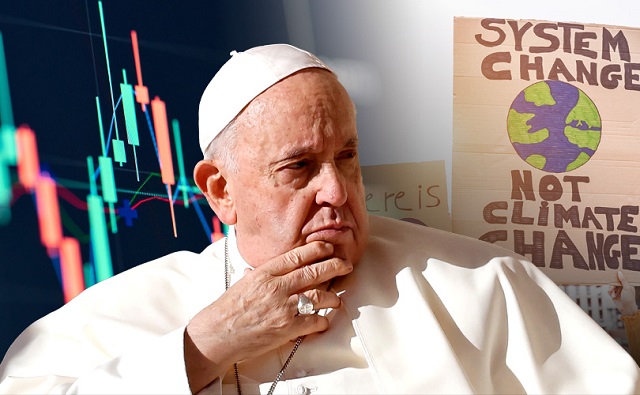

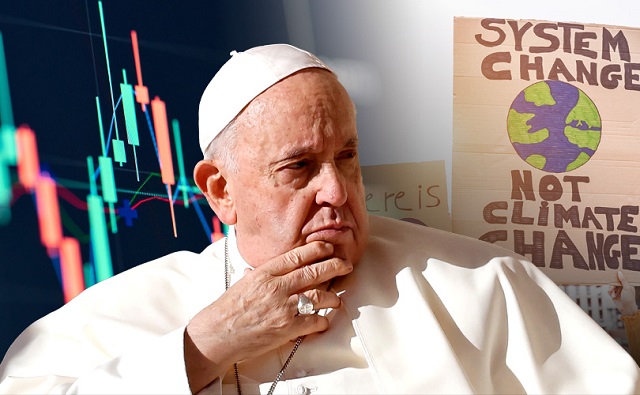

Energy2 days agoPope Francis calls for ‘global financial charter’ at Vatican climate change conference

-

Bruce Dowbiggin2 days ago

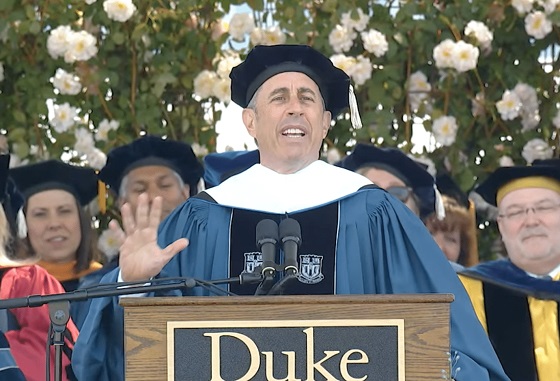

Bruce Dowbiggin2 days agoJerry Came to See The Babies. And They Walked Out On Him